- Build & audit LBOs, DCFs, and portfolio models faster and with confidence

- Create error-free & on-brand IC memos, fundraising decks, and LP reports

- Access approved digital assets, templates, logos with centralized libraries

How Private Equity Teams Use Macabacus

Build Deal-Ready Models

Link Models to Slides

Build Decks Faster

Firmwide DAM

Generate Templated Docs

Top Features Used By Private Equity Teams

Link Excel to PowerPoint

Seamlessly link model outputs, and charts into IC decks and LP reports. One-click refresh keeps numbers current without breaking formatting.

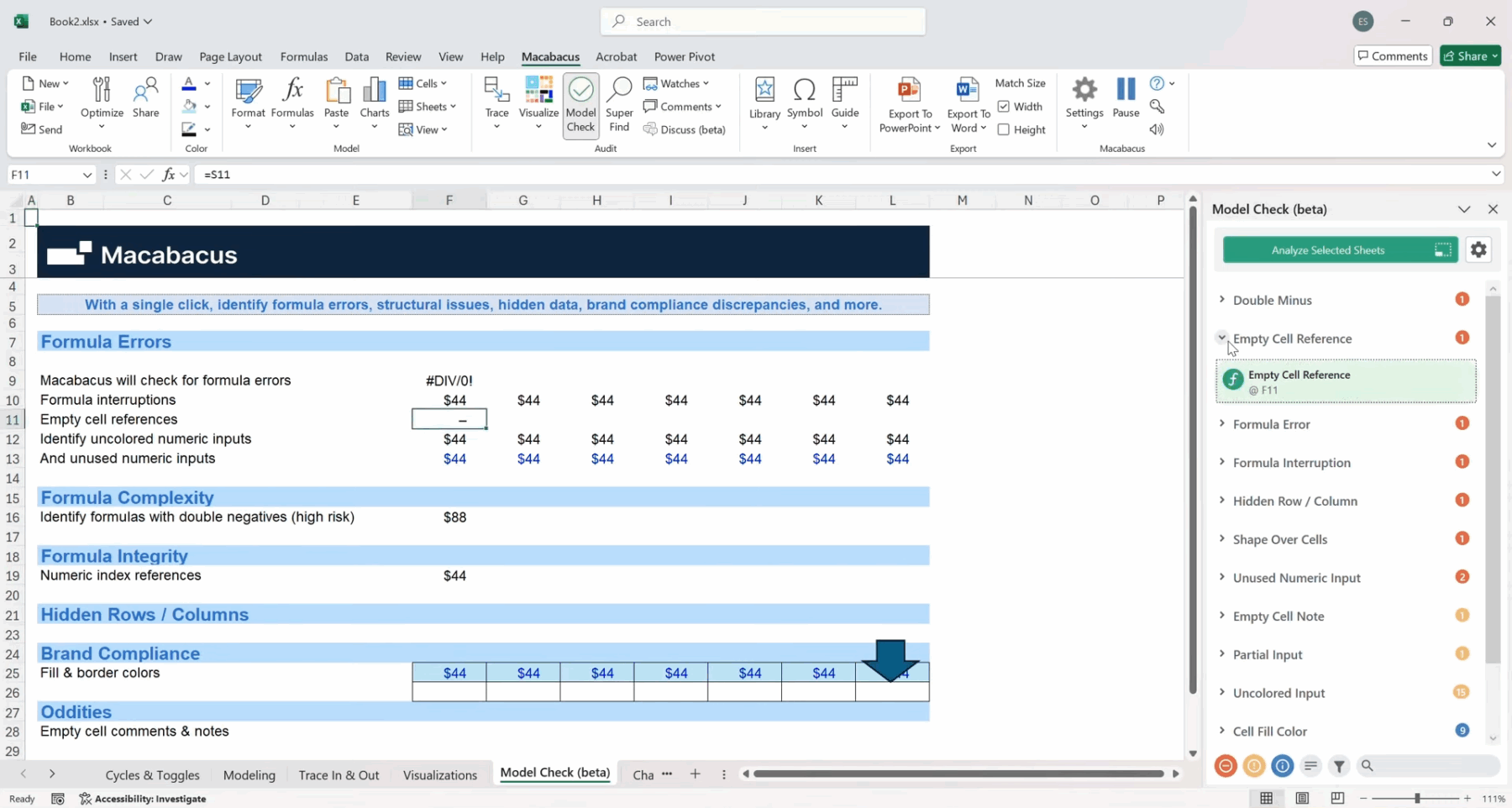

Model Check

Run comprehensive checks to catch hardcodes, broken links, and circularity before partner or investor review.

Presentation Templates

Apply firm templates, styles, pagination, and layout fixes automatically so decks stay clean and on-brand.

Deck Check

Polish your PowerPoint slides in seconds with automated checks for errors, typos, and inconsistencies.

Shared Libraries

Centralize approved slides, components, and logos so teams build from a single source of truth.

Doc Builder

Generate NDAs, investor letters, and memos from guided questionnaires and keep language consistent across documents.

Frequently Asked Questions

We’re happy to answer any questions you have about Macabacus! Feel free to check out the Help Center, or email [email protected].

Can Macabacus help with portfolio company modeling?

Yes—Macabacus speeds up model updates and analysis while reducing risk of error, so you can focus on what the numbers mean—not just building them.

How does it help with IC decks and investment memos?

Use templates and shared libraries to create professional, on-brand materials fast, with live-linked data and zero formatting headaches.

Is Macabacus useful beyond the deal team?

Absolutely. Ops teams and IR professionals use Macabacus to standardize reporting, streamline internal deliverables, and ensure firmwide alignment.

What makes Macabacus different for PE firms?

It’s fast, flexible, and built for high-output teams that can’t afford to waste time on formatting, rework, or manual updates. It scales with your workflow.