- Refresh performance, attribution, and holdings instantly across factsheets and client decks

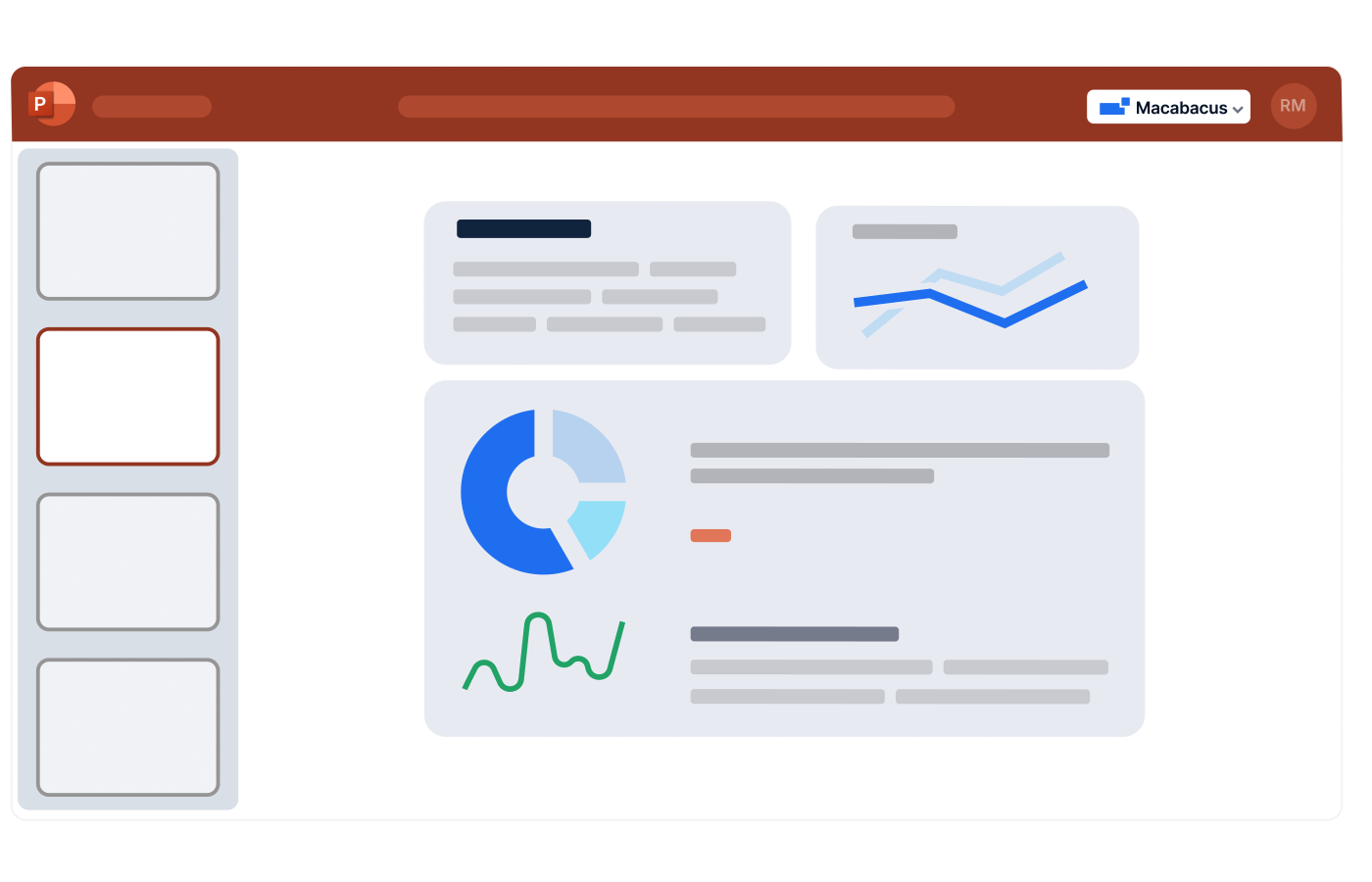

- Deliver on-brand factsheets and investor decks

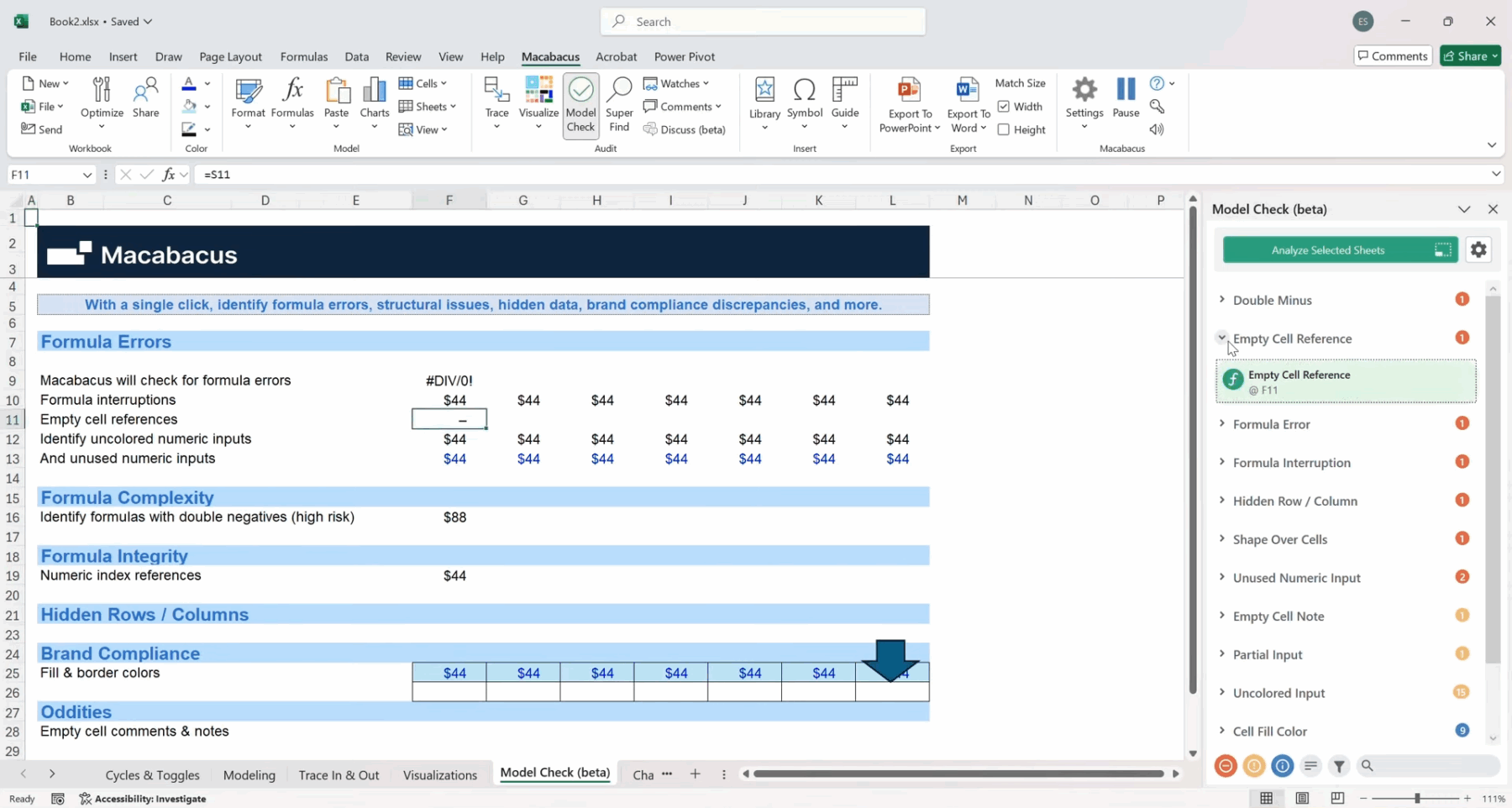

- Eliminate modeling errors or inconsistent formatting before distribution to investors

How Asset Management Teams Use Macabacus

Polished Investor Decks

Enforce Compliance

Centralized DAM

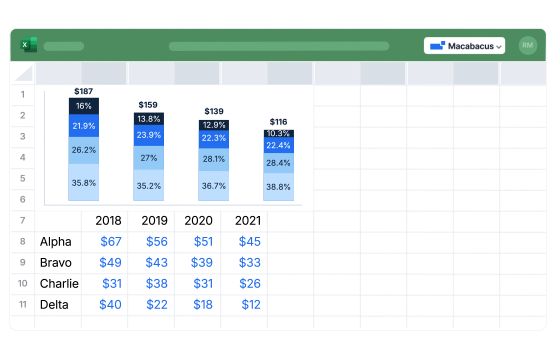

Create Advanced Charts

Build Investor & RFP Documents

Top Features Used By Asset Managers

Link Excel to PowerPoint

Keep factsheets and client decks synced to current performance and holdings with one‑click refresh.

Presentation Templates

Apply templates, styles, pagination, and layout rules automatically for distribution‑ready pages.

Deck Check

Catch typos, spacing issues, and off brand elements to ensure polished investor presentations.

Shared Libraries

Centralize approved slides, logos, disclosures, and components for consistent materials across teams.

Charting Tools

Create brand‑consistent performance and allocation charts that stay linked to the model.

Doc Builder

Produce RFPs, DDQs, and investor commentary in minutes. Guided questionnaires auto-fill documents, and Corporate Dictionary ensures usage of compliant language & terminology.

Frequently Asked Questions

We’re happy to answer any questions you have about Macabacus! Feel free to check out the help center, or email [email protected].

Can Macabacus help with pitchbooks and factsheets?

Yes—Macabacus automates formatting, ensures brand consistency, and links data across Excel and PowerPoint to save time and reduce errors.

Does it support marketing and distribution teams?

Absolutely. Shared libraries and brand controls make it easy for sales and marketing to create client-ready materials without going off-script.

How does it reduce compliance risk?

Macabacus flags inconsistencies, broken formulas, and outdated disclosures—so nothing gets through that shouldn’t.

Is Macabacus scalable for global asset managers?

Yes—Macabacus is used by large teams across regions to maintain brand integrity and operational efficiency at scale.