- Build cap tables, ownership models, and portfolio updates faster and error-free

- Deliver polished, on-brand fundraising decks, IC memos, and LP reports

- Centralize access to templates, logos, and disclosures with a firm-wide DAM

How Venture Capital Teams Use Macabacus

Simplify Startup Modeling

Link Excel to PPT

Access Branded Content

Enforce Brand Compliance

Create Templated Docs

Top Features Used By Venture Capital Teams

Link Excel to PowerPoint

Keep KPIs, runway, ownership, and charts synced in partner and IC decks with one-click refresh.

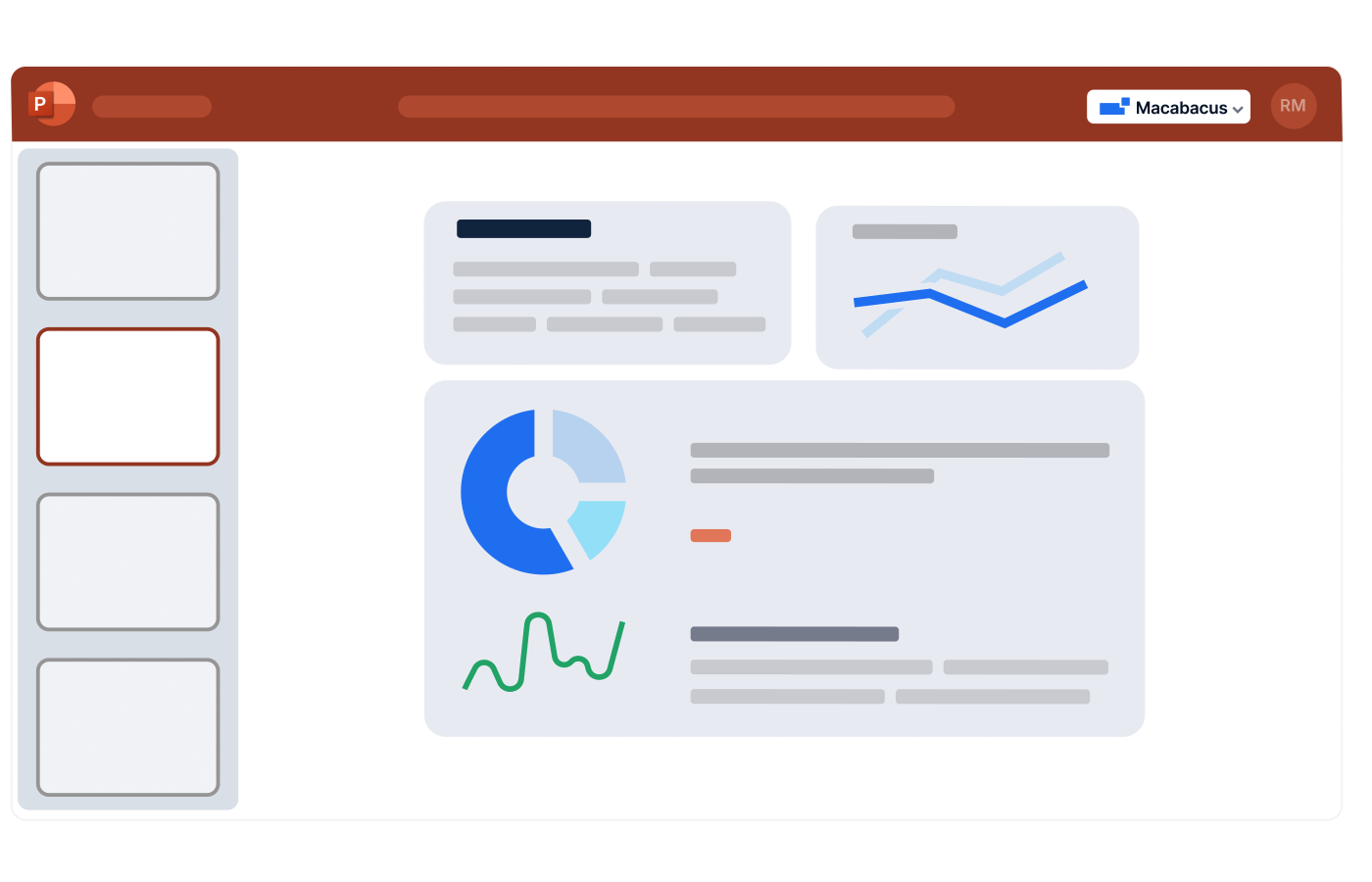

Presentation Templates

Apply firm templates, styles, pagination, and layout fixes automatically so decks stay clean and on-brand.

Deck Check

Polish your PowerPoint slides in seconds with automated checks for errors, typos, and inconsistencies.

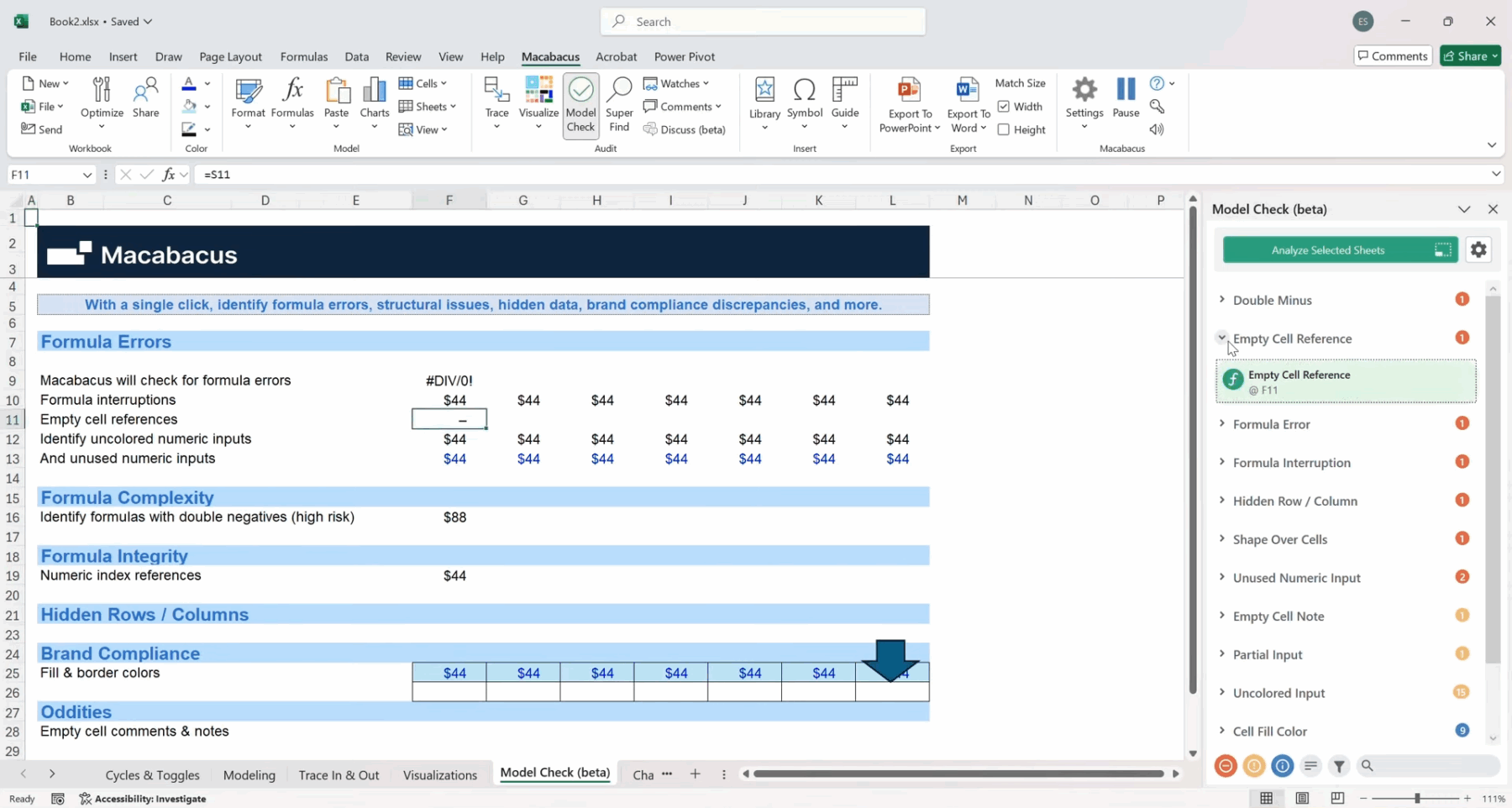

Model Check

Run comprehensive checks to catch hardcodes, broken links, and circularity before partner review.

Shared Libraries

Centralize approved slides, components, and logos so the firm builds from a single source of truth.

Doc Builder

Generate IC memos, deal one-pagers, and investor letters in minutes from guided questionnaires and ensure compliant terminology with Corporate Dictionary.

Frequently Asked Questions

We’re happy to answer any questions you have about Macabacus! Feel free to check out the Help Center, or email [email protected].

How can Macabacus help with financial modeling in VC?

Macabacus speeds up startup modeling with dynamic templates and formula tools that eliminate manual errors—perfect for lean teams under pressure.

Can Macabacus streamline pitch deck creation?

Yes—automate formatting, ensure brand compliance, and link data across slides to build pitch decks faster and smarter.

What role does Macabacus play in due diligence?

Macabacus offers transparent, scalable pricing with no hidden fees. Our latest pricing is always available on our pricing page, so you know exactly what to expect—whether you’re an individual user or an enterprise team.

Is Macabacus useful for small VC teams?

Absolutely. Whether you’re solo or scaling, Macabacus amplifies output and standardizes your materials—so everyone looks like a top-tier firm.