Featured Post

Featured Post

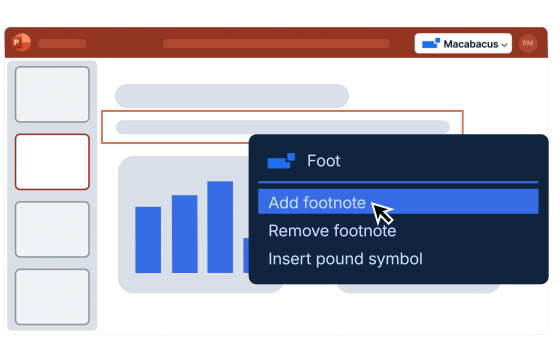

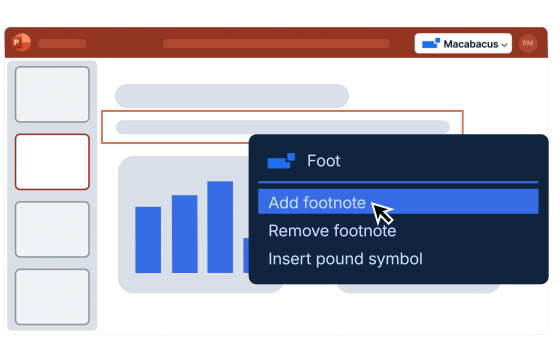

Introducing Omnibar: The Fastest Way to Find the Right PowerPoint Tool

Omnibar Finds the Right PowerPoint Tools Faster

Product news, tips, newsletters, and more – delivered straight to your inbox.

By submitting your email address, you consent to receive email messages (including discounts and newsletters) regarding Macabacus’ products and services. You may withdraw your consent and unsubscribe from these communications at any time. For more information, check out our Privacy Policy.