What is the Macabacus Long-Form LBO Model ?

The Macabacus long-form LBO model is derived from actual LBO models used by four bulge bracket investment banks, incorporating the best practices and features of each. We believe it sets a new standard for balancing complexity and intuitive use among LBO models. Our model implements key concepts related to LBO modeling, including revolving credit facilities, senior debt, subordinated debt, and preferred stock financing; fixed and floating interest rates; cash sweep; original issue discount (OID); payment-in-kind (PIK) instruments; and much more. You will find annotations throughout the model to facilitate your understanding of its structure and assumptions.What is a LBO Model?

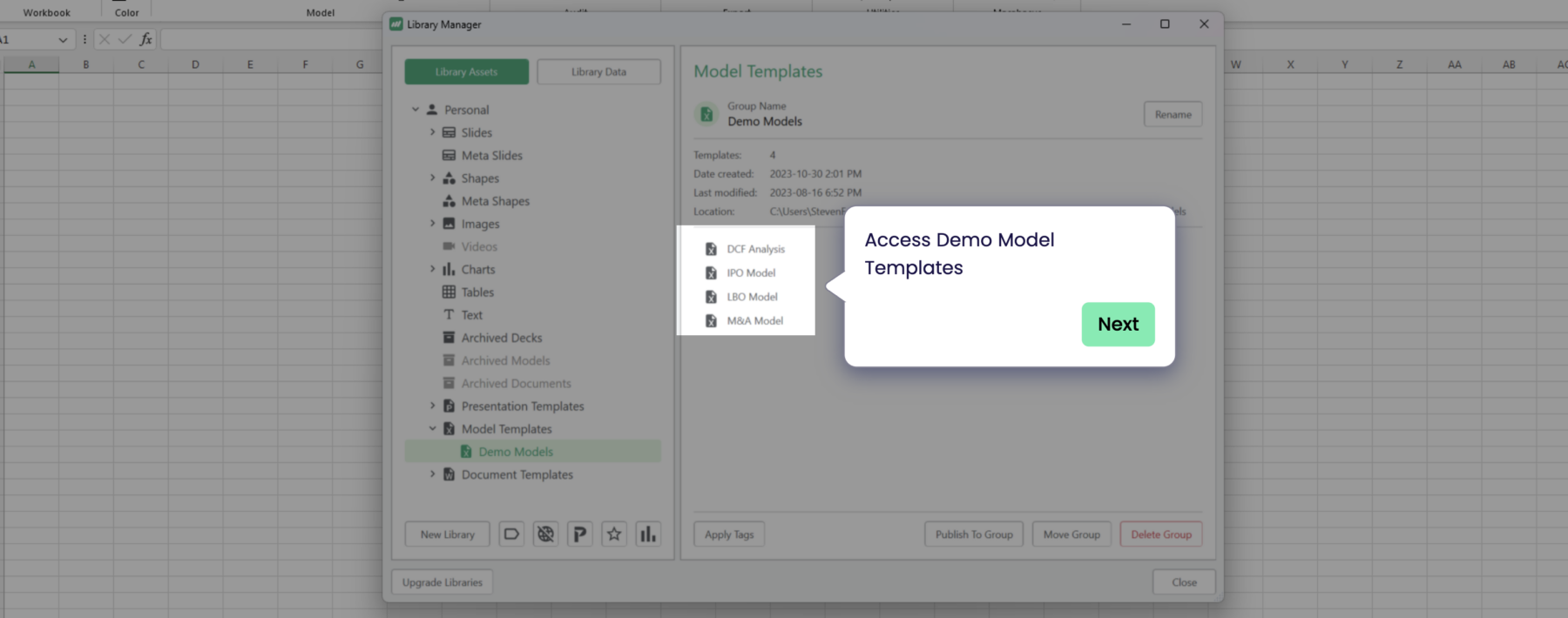

An LBO (Leveraged Buyout) model is a financial tool used to evaluate the feasibility of acquiring a company using mostly borrowed funds. It forecasts cash flows to ensure the company can repay its debt and generate returns for investors. This model is essential for structuring deals and assessing potential profits in leveraged buyouts. Add LBO model link)The BX Atlas LBO model is known for its streamlined interface and focus on scalability, whereas the Macabacus LBO model offers a broader range of annotations for beginners.

Why Use a Long LBO Model?

A long LBO model offers a detailed, comprehensive analysis of a leveraged buyout, providing deeper insights into the financial viability and potential returns of a deal. Unlike a standard LBO model, which may focus on basic cash flows and debt repayment, a long LBO model includes more intricate projections, such as detailed revenue breakdowns, cost structures, multiple debt tranches, and sensitivity analyses. This level of detail helps investors assess various scenarios, optimize capital structure, and understand the impact of different operating strategies on the company’s financial performance. It’s particularly useful for complex transactions, where small changes in assumptions can significantly affect the outcome. By using a long LBO model, investors can make more informed decisions, identify potential risks, and develop a more strategic approach to maximizing returns and minimizing risks in leveraged buyouts.Elevate Your Skills with Comprehensive LBO Model Training

For professionals aiming to master financial modeling, LBO model training offers a comprehensive approach to understanding leveraged buyouts. This training emphasizes the practical application of concepts such as debt schedules, cash flow forecasts, and return analyses. Participants learn how to construct robust models from scratch, evaluate different financing structures, and interpret key metrics like IRR and cash-on-cash return. With a focus on real-world scenarios, LBO model training bridges the gap between theoretical knowledge and practical skills, preparing attendees for success in private equity and corporate finance roles.

Key Components of an LBO Long Model Template:

An LBO long model template includes several detailed components that provide a comprehensive view of a leveraged buyout. It starts with transaction assumptions, such as purchase price, financing structure, and fees, which outline the deal’s foundation. Next is the financial projections section, forecasting revenues, expenses, and cash flows over the investment period to evaluate the company’s performance. A detailed debt schedule follows, breaking down various debt tranches, interest payments, and repayment plans. The cash flow analysis is crucial, showing whether the company can generate enough cash to service its debt and provide returns to investors. Finally, the template includes sensitivity and scenario analyses, which test different financial and operational assumptions to assess risks and potential returns. These components together form a robust tool for analyzing and planning leveraged buyout transactions.Advanced Features of an LBO Template:

An LBO long model template includes advanced features that provide deeper insights into a leveraged buyout’s dynamics. One key feature is scenario analysis, allowing you to model different financial and operational scenarios, such as changes in market conditions or company performance, to see their impact on returns. Sensitivity analysis is another critical tool, testing how changes in variables like interest rates or growth rates affect key metrics such as IRR and cash-on-cash return. The template may also include an equity waterfall, which details how proceeds are distributed among investors based on different performance levels. Additionally, some models integrate detailed capital structure optimization, helping to identify the best mix of debt and equity to maximize returns while managing risk. These features make the LBO long model a powerful tool for evaluating complex transactions and making informed investment decisions.How the Macabacus Operating Model Simplifies Financial Planning

The Macabacus long-form LBO model is inspired by real-world models used by leading investment banks, combining best practices to create a balanced, intuitive tool for analyzing leveraged buyouts. This model excels in simplifying complex LBO concepts such as revolving credit facilities, senior and subordinated debt, preferred stock financing, fixed and floating interest rates, cash sweeps, original issue discount (OID), and payment-in-kind (PIK) instruments. Annotations throughout the model offer clear explanations of its structure and assumptions, making it a valuable resource for both professionals and learners.