Key Components of the Discounted Cash Flow Analysis

This Discounted Cash Flow (DCF) model, is a powerful tool designed to provide a detailed financial analysis. It helps in making informed business decisions by calculating the value of an investment, based on its expected future cash flows. This is an essential component in financial analysis.

One key compontent is the perpetuity growth rate. This refers to the expected rate at which an investment will generate cash flows indefinitely. This model can accurately compute the perpetuity growth rate implied by the terminal multiple method and vice versa. It can also perform a sensitivity analysis over a range of assumed terminal multiples and perpetuity growth rates, providing a comprehensive evaluation of potential investment scenarios.

A key feature of the DCF template is the capability to perform DCF valuations manually. This provides greater flexibility and precision, especially when dealing with complex scenarios. The model also uses XNPV formulas to double-check the calculations – a fantastic safety feature that ensures the accuracy of your data and analysis.

Discounted Cash Flow (DCF) Terminology

As you explore the Macabacus DCF template or any DCF Excel model, you will encounter a couple of terms and procedures.

- Terminal Value: The Terminal Value is a critical component of the DCF analysis, which estimates the value of a business beyond the forecast period. This calculation recognizes that businesses often generate cash flows well beyond a typical forecast horizon.

- WACC (Weighted Average Cost of Capital): The WACC is the discount rate used in DCF analysis to bring future cash flows back to their present value. It represents the opportunity cost of investing in a company or project.

- Free Cash Flow: This is the cash flow available to all the capital providers in a company. It’s the cash left over after a company has paid its operating expenses and capital expenditures.

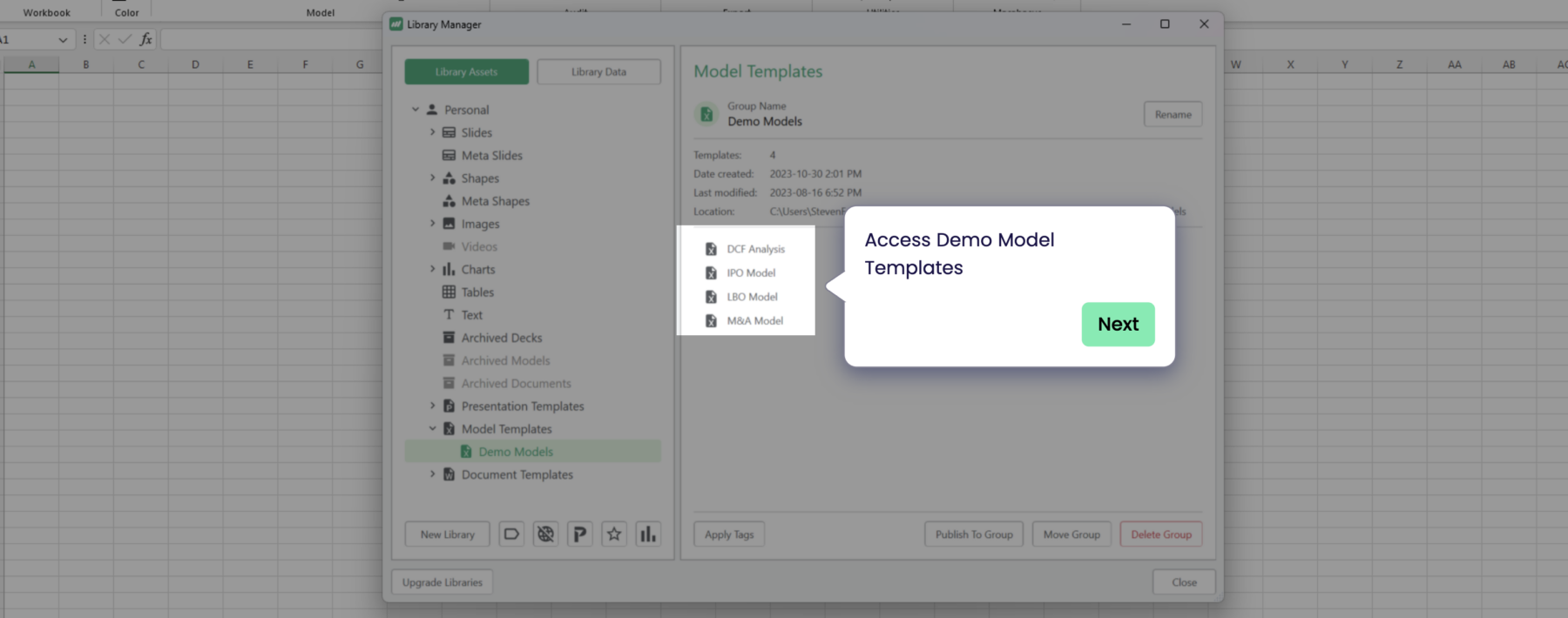

Robust DCF Model Templates

The use of a discounted cash flow Excel model helps analysts with the process of conducting DCF analysis, helping to save time and reduce the chances of costly errors. You can use these tools to create complex financial analyses. Focus more on the analysis and less on the manual calculations.

Download the template