Key functionalities of the Macabacus Merger Model Template

Mergers and acquisitions are transformative events in a company’s lifecycle, and a comprehensive, accurate model is a pivotal part of these transactions. It helps in determining the deal’s feasibility, estimating the financial impact, and planning the post-merger integration. The Macabacus merger model offers a highly detailed and flexible framework for these analyses.

A few key functionalities in this M&A Excel template include:

- Multiple Financing and Capitalization Scenarios: This enables the user to simulate various scenarios based on different financing options and capital structures, aiding in the decision-making process.

- Third-Party Financing: The model can simulate scenarios where external financing is used for the transaction, providing a more accurate picture of the deal’s financial implications.

- Asset or Stock Deal Structure: This function allows the user to evaluate the financial impact of the deal, whether it’s structured as an asset purchase or a stock purchase.

- IRC Section 338 Elections: IRC Section 338 allows for a “step-up” in the basis of assets in a stock acquisition, which can result in future tax deductions. The model takes this into account in its calculations.

- Net Operating Losses (NOLs) and Limitation under IRC Section 382: The model includes functionality to model NOLs and their usage, limited under IRC Section 382 following an ownership change.

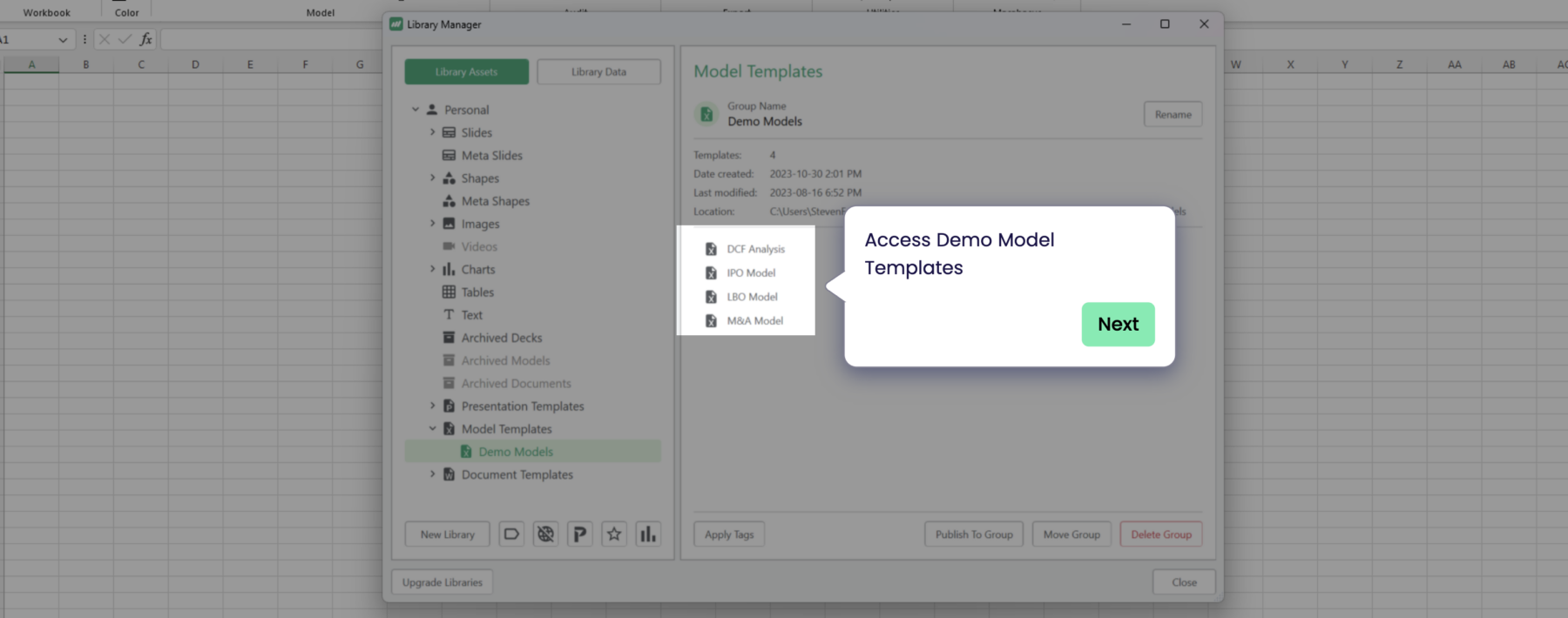

Download the template

How to use the Macabacus M&A Model Template – Example

Consider a hypothetical example where Company A is planning to acquire Company B. With the Macabacus merger model, the financial analysts at Company A can run multiple financing and capitalization scenarios, such as using internal cash reserves, raising debt, or issuing new equity. They can also simulate the impact of third-party financing on the company’s financials.

If Company B has substantial NOLs, the analysts can model the limitations on their usage under IRC Section 382 due to the ownership change. If the deal is structured as a stock acquisition, the analysts can model the impact of IRC Section 338 elections and estimate future tax savings due to the step-up in the basis of assets.

How to perform Multiple Scenario Analysis with the Macabacus Merger Model Template

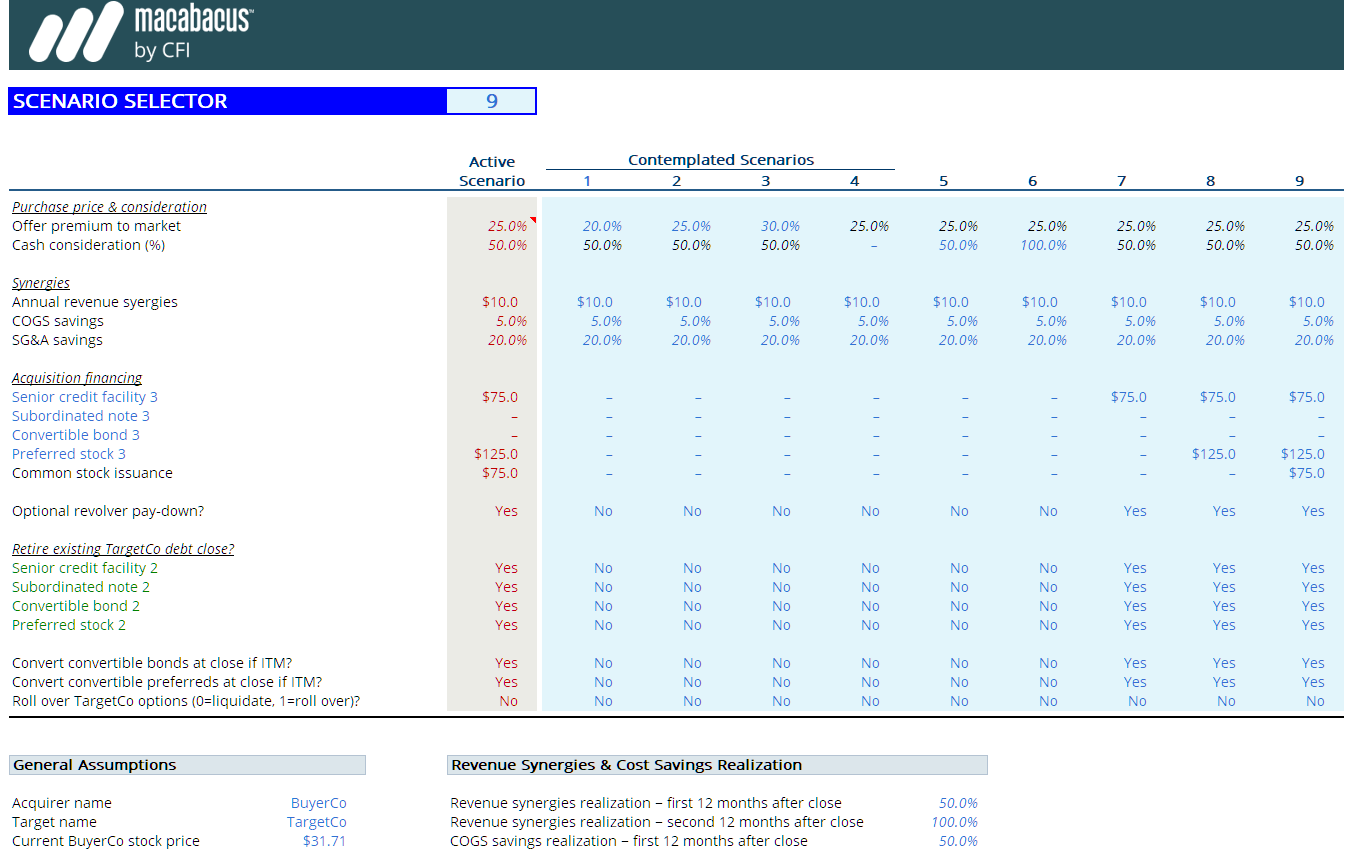

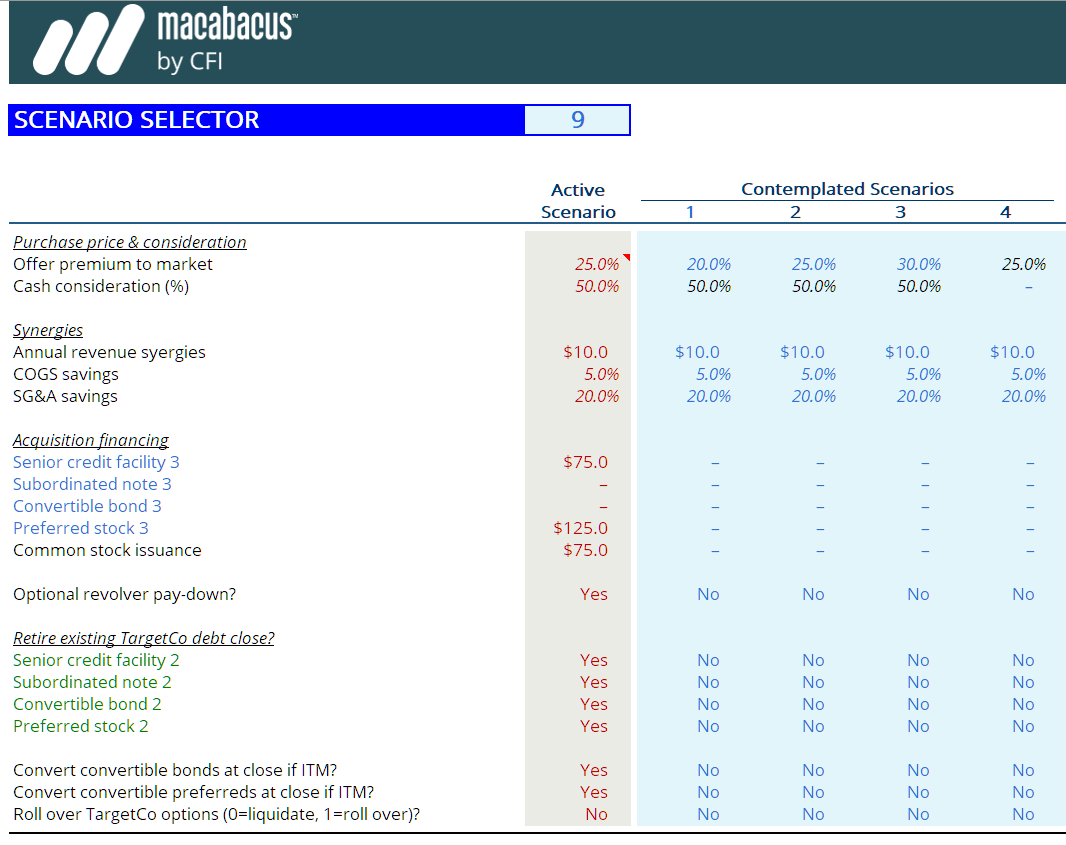

One of the standout features of this M&A model template is its ability to handle multiple scenarios side by side. This feature is a powerful analytical tool, allowing you to compare the implications of different financial, operational, or strategic decisions within the context of the proposed merger or acquisition.

For instance, you can input varying financing strategies, capital structures, or deal structures, and the model will present the financial outcomes of each scenario in a comparative format. This might include differences in earnings per share, debt ratios, return on investment, or any other financial metrics that are crucial to your decision-making process. This ability to compare ‘what if’ scenarios side by side not only saves considerable time but also offers clarity, making it easier to evaluate the relative merits and potential risks associated with each option.

The side-by-side comparison feature enables strategic planning with a data-driven approach. It ensures that decisions aren’t based on single-point estimates but rather consider a range of possible outcomes. By exploring multiple scenarios, you can better anticipate potential challenges, adjust your strategies proactively, and thereby increase the likelihood of a successful transaction.

Unlock M&A Insights with the Merger Model Template

Despite its advanced functionalities, this merger template should be adapted to the specific transaction at hand. It is an invaluable tool for financial analysts and investment bankers in the complex, high-stakes world of M&A transactions. Its effective utilization requires a strong understanding of operating and M&A models, as well as the intricate dynamics of the merger process. However, with this knowledge and the right model at their disposal, professionals can unlock new levels of insight and precision in their analysis.

Download the template

The Macabacus merger model implements advanced M&A, accounting, and tax concepts, and is intended for use in modeling live transactions (with some modification, of course). Advanced functionality includes multiple financing and capitalization scenarios, third-party financing, target debt repayment, asset or stock deal structure, IRC Section 338 elections, net operating losses and their limitation under IRC Section 382, and more. Given the complexity of this template, be sure you are comfortable with how to build an operating model and an M&A model.

The Macabacus merger model implements advanced M&A, accounting, and tax concepts, and is intended for use in modeling live transactions (with some modification, of course). Advanced functionality includes multiple financing and capitalization scenarios, third-party financing, target debt repayment, asset or stock deal structure, IRC Section 338 elections, net operating losses and their limitation under IRC Section 382, and more. Given the complexity of this template, be sure you are comfortable with how to build an operating model and an M&A model.