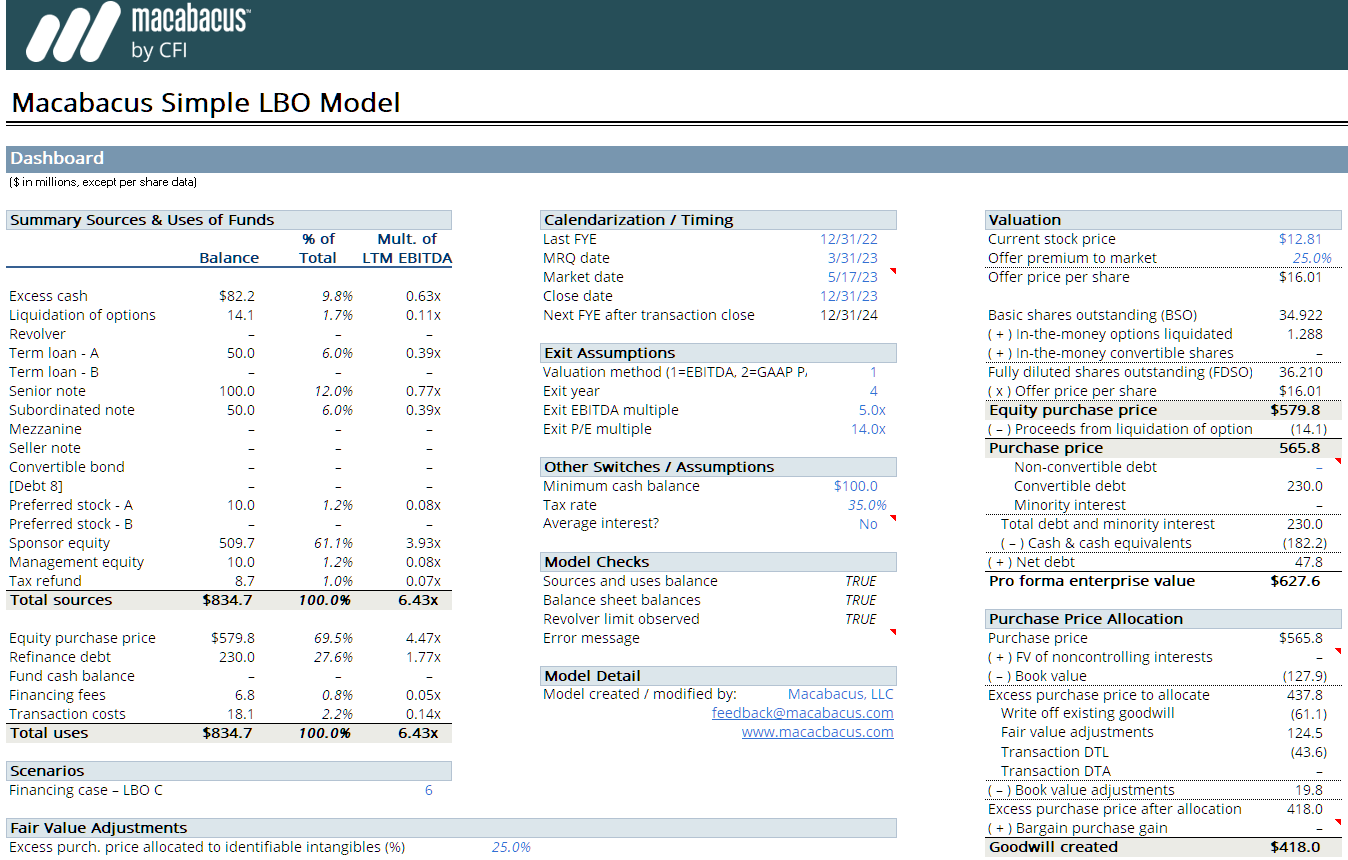

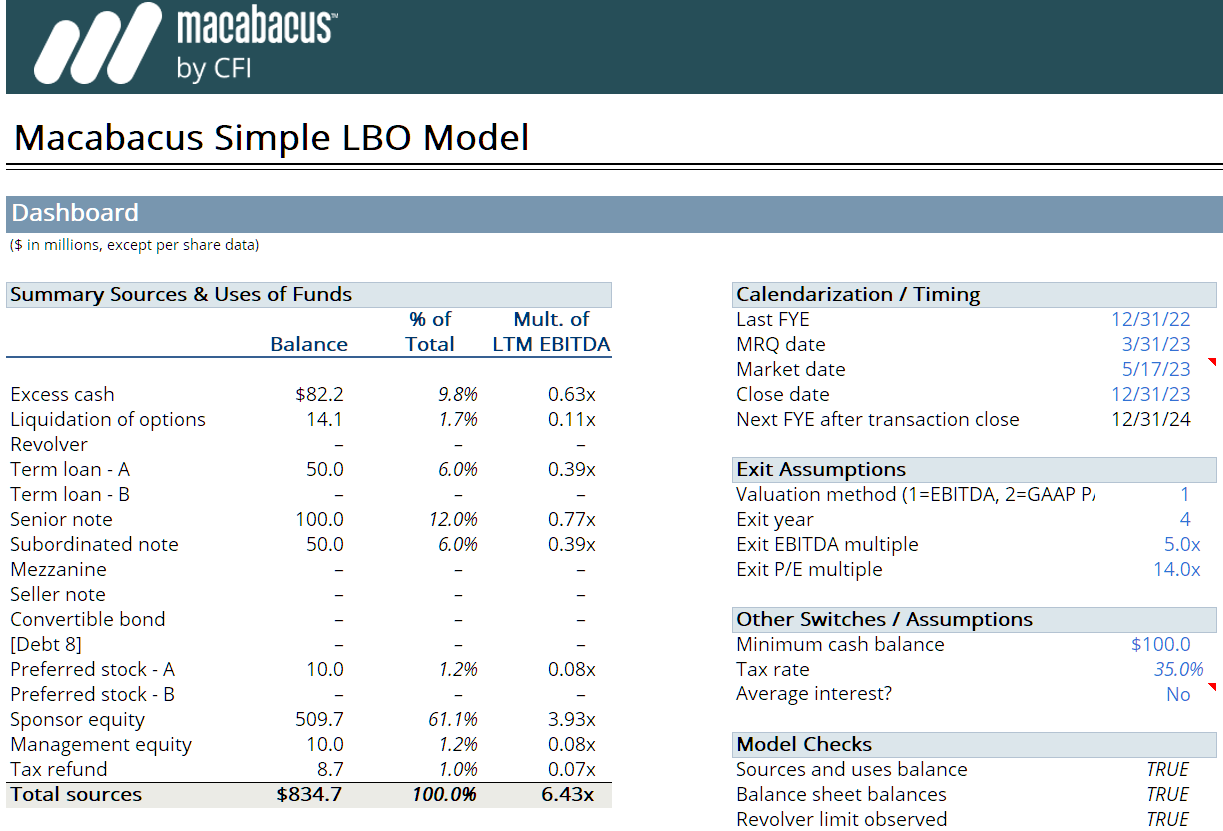

The Macabacus short-form LBO model implements key concepts related to LBO modeling and is an excellent starting point for understanding the basics of how LBOs work. It is derived from our long-form model, which itself is built upon four bulge bracket LBO models. Features include multiple capitalization scenarios, revolving credit facilities, senior debt, subordinated debt, preferred stock financing, fixed and floating interest rates, cash sweep, and much more.

The Macabacus short-form LBO model implements key concepts related to LBO modeling and is an excellent starting point for understanding the basics of how LBOs work. It is derived from our long-form model, which itself is built upon four bulge bracket LBO models. Features include multiple capitalization scenarios, revolving credit facilities, senior debt, subordinated debt, preferred stock financing, fixed and floating interest rates, cash sweep, and much more.

Simplify LBO Analysis with Short LBO Model Template

Discover more topics

Webinar: The AI Edge in Investment Banking

Join experts from Macabacus & LSEG to learn practical insights about AI’s influence on the future of banking.

Read more

DCF Excel Template

Elevate your investment analysis with our free DCF model template. Understand discounted cash flow principles and perform accurate valuations in Excel.

Read more

Operating Model Excel Template

Download our free operating model Excel template. Forecast revenue, expenses, and key financial metrics for better decision-making.

Read more

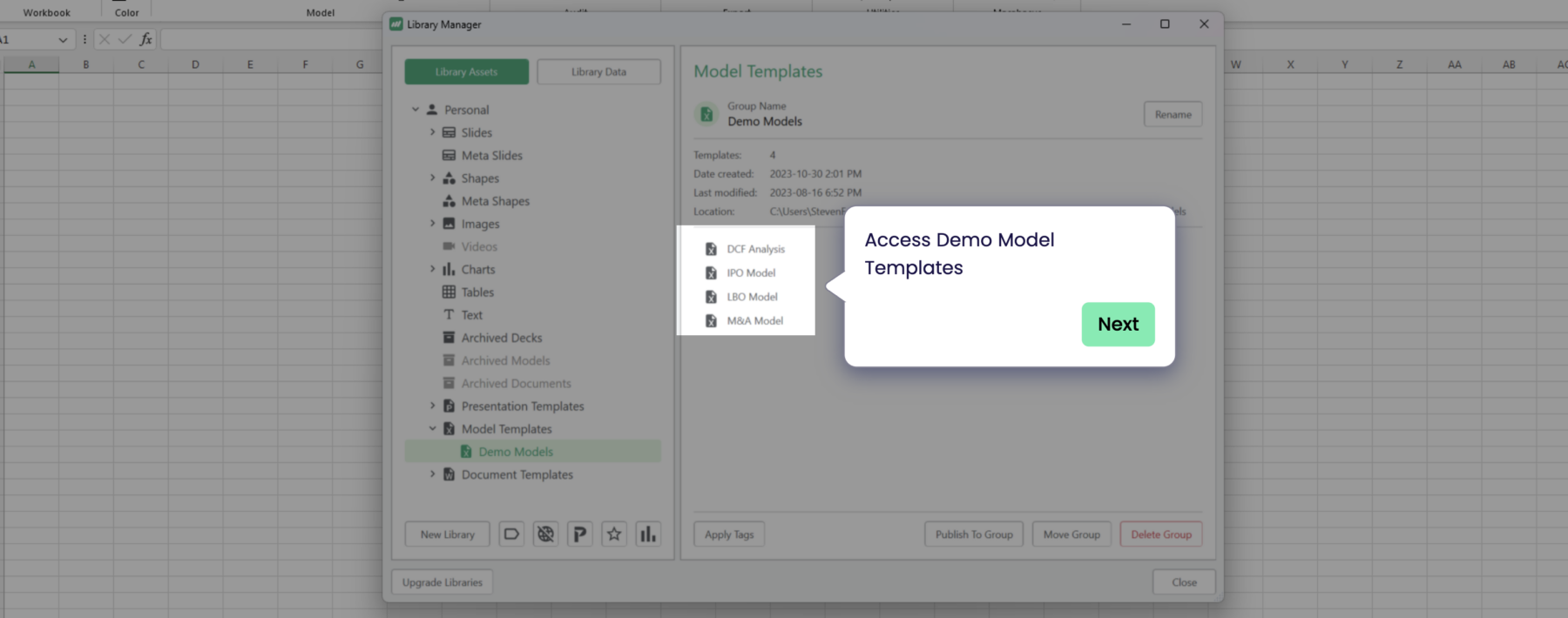

LBO Excel Model

Try LBO modeling with our comprehensive Excel template. Understand key concepts, calculate returns, and gain actionable insights.

Read more