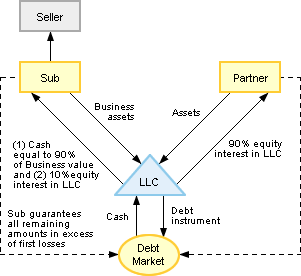

- A leveraged partnership structure allows a seller to transfer most of the economic interest in a business in exchange for cash without triggering current taxes

- The seller must find a strategic or financial partner to form a partnership

- Substantially all of the economics (i.e. up to 90%) and effective control of a business can be allocated to the purchaser.

- The seller receives cash proceeds through a leveraged distribution by the partnership.

- In the typical structure, the seller guarantees the debt of the partnership in an amount equal to the cash distributed to the seller.

- To reduce the costs associated with financing, (i) the purchaser can provide the financing (so long as the seller guarantees its repayment) or (ii) the purchaser can be a co-guarantor so long as the seller indemnifies the purchaser for any costs it bears as guarantor.

- If an affiliate of the seller were to guarantee the debt, the affiliate's asset value would generally only need to be approximately 25-30% of the total amount of debt guaranteed, allowing the remaining 70-75% of value to be distributed to the seller (provided there is sufficient equity cushion in the partnership and the guarantee is unlikely to be called).

- The seller's tax gain is deferred, in general, until such time as (i) the seller exits the partnership, (ii) the assets of the partnership contributed by the seller are sold, (iii) the debt is repaid, or (iv) the guarantee no longer exists.

- The seller can retain a put right on its residual equity interest to ensure liquidity for exit and the purchaser can have a call right after a certain time period to compel such exit.

- This structure also has the potential to give the seller a tax-deferred exit after seven years.

- In sum, a properly structured leveraged partnership provides substantial tax-deferred cash with relatively low tax risk and minimal economic exposure to the business being sold.

- Precedent transactions: Georgia Pacific/Chesapeake, LIN Television/NBC

Transaction Structure

| Benefits | Considerations | |

|

|

|

|

||

Bottom Guarantee

To reduce Seller's credit exposure on the guarantee, a "bottom guarantee" structure can be utilized. |

|