Advanced Date Functions Relevant to Finance

DATEDIF

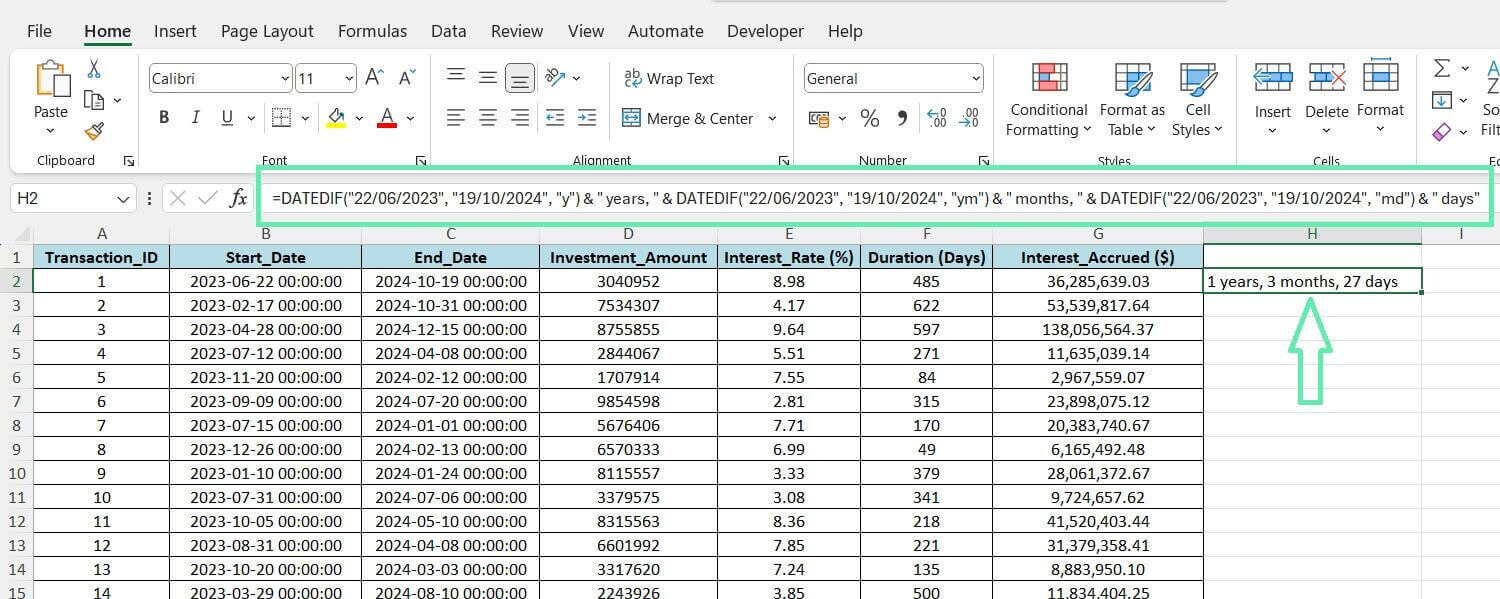

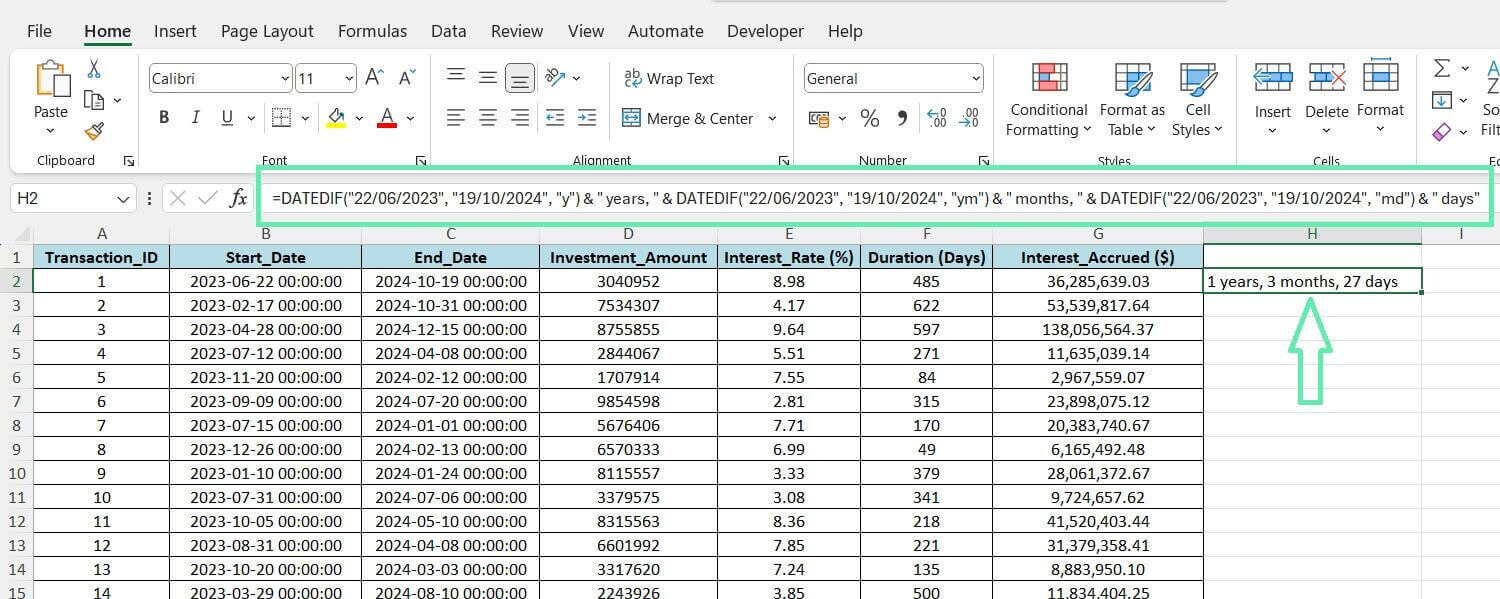

With the basics covered, let’s delve into more advanced data functions relevant to finance. The DATEDIF function in Excel calculates the difference between two dates in years, months, and days. It is beneficial for calculating investment periods that span different time units.

An investment that starts on June 22, 2023, and matures on October 19, 2024, lasts one year, three months, and 27 days. The `DATEDIF` function can be used for financial calculations, such as interest accrual and investment performance analysis.

=DATEDIF(“22/06/2023”, “19/10/2024”, “y”) & ” years, ” & DATEDIF(“22/06/2023”, “19/10/2024”, “ym”) & ” months, ” & DATEDIF(“22/06/2023”, “19/10/2024”, “md”) & ” days”

The above formula breaks down as follows:

- The first DATEDIF calculates the full years between the two dates.

- The second DATEDIF calculates the remaining months after counting full years.

- The third DATEDIF calculates the days between the two dates, ignoring full months and years.

NETWORKDAYS` and `NETWORKDAYS.INTL` are functions that can calculate the number of working days between two dates while considering weekends and public holidays. The information can help refine interest calculations and comply with financial regulations.

In addition, the above features enable you to customize workweeks and holiday calendars to meet the specific needs of diverse financial markets and jurisdictions. Incorporating advanced data functions can enhance the precision and reliability of your financial models and analyses.

Applying Date Calculations to Financial Scenarios

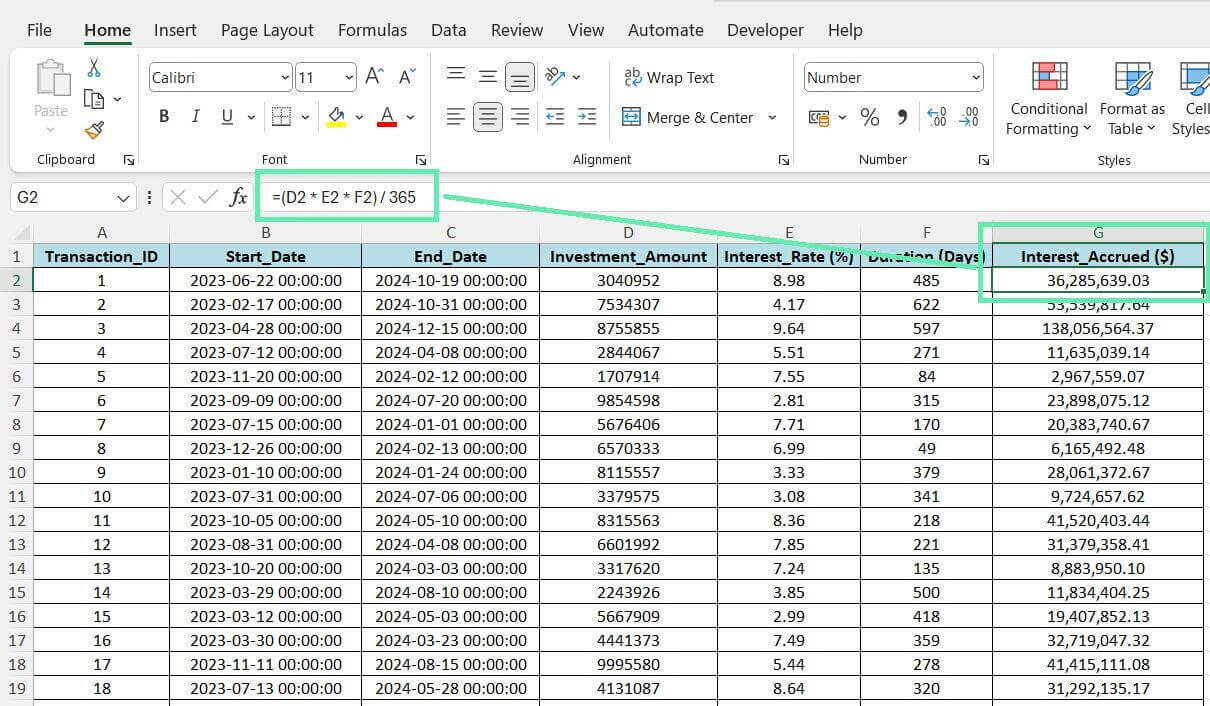

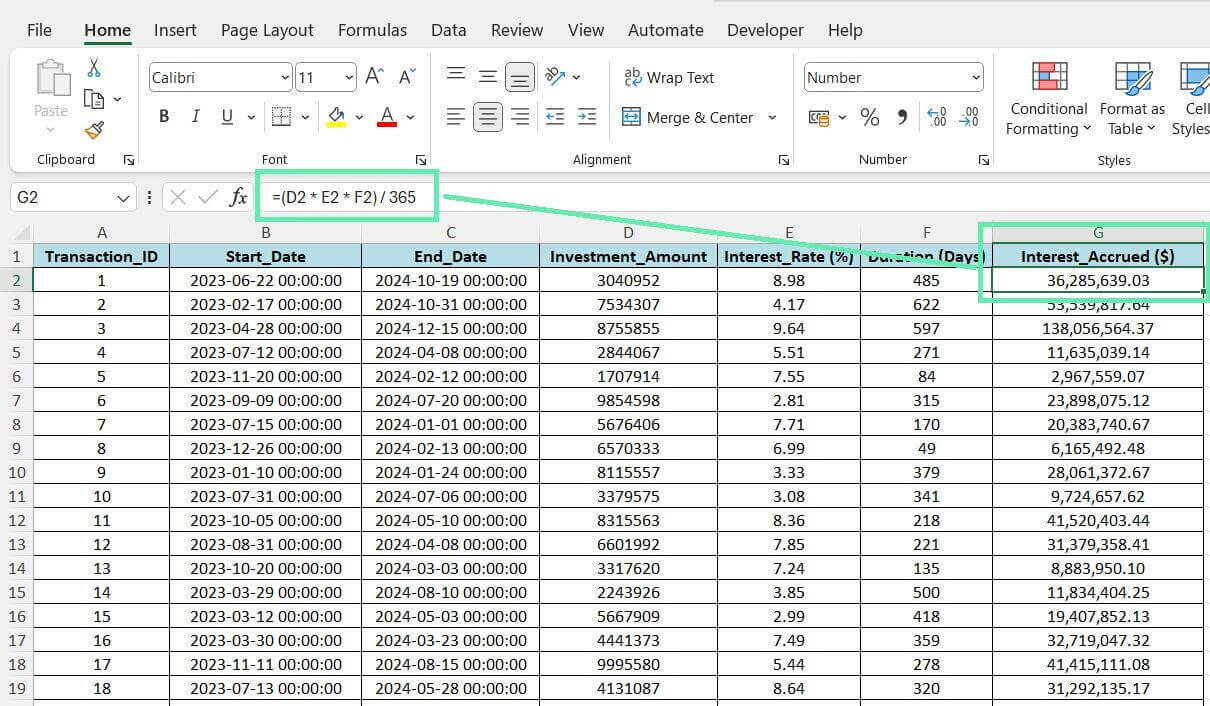

Now that you fully grasp date calculations, let’s delve into how to use the given techniques in practical financial situations. Calculating the accrued interest on investments is possible by considering the start and end dates, investment amounts, and interest rates of the data set mentioned earlier.

To find accrued interest, determine the days between the start and end dates and use the formula (Investment Amount × Interest Rate × Number of Days) ÷ 365.

Automating the above calculation using Excel formulas allows you to efficiently determine the accrued interest for multiple investments simultaneously. Such a capability is critical when dealing with large portfolios or complex investment structures.

Accurately predicting upcoming cash flows is essential for efficient liquidity management and effective financial planning, especially when projecting cash flows based on investment maturity dates. It helps in making well-informed investment decisions and optimizing resource allocation.

Tips for Efficient Date Calculations in Financial Models

To improve efficiency and accuracy when working with date calculations in financial models, consider the following expert tips:

- Pay close attention to leap years and the specific conventions used for interest calculations in your organization or industry. Ensure that your formulas account for the said variations to maintain precision.

- Automate repetitive date calculations using Excel’s powerful features, such as named ranges, tables, and cell referencing. Set up dynamic formulas linked to your dataset to minimize manual input and reduce the risk of errors.

- Avoid date calculation mistakes by using consistent formats and accounting for weekends and holidays. Check your formulas regularly and validate your results for accuracy.

- Use Excel’s built-in date functions, such as `DATE`, `YEAR`, `MONTH`, and `DAY`, to extract specific components of dates for further analysis or formatting purposes.

- Consider using custom functions or macros as they improve date calculations in financial models and reduce errors.

Improve date calculation skills in Excel and enhance financial models by implementing the abovementioned tips and best practices.

Conclusion

Mastering Excel date calculations is crucial for finance professionals. Understanding advanced functions allows you to optimize investment strategies for better results. Accurate date calculations provide a strategic advantage in the fast-paced finance sector. Always strive to improve your Excel proficiency for better decision-making.

For those looking to enhance their productivity further, Macabacus offers various tools designed specifically for finance teams. Macabacus enables you to be more efficient and accurate in Excel, PowerPoint, and Word, allowing you to focus on financial analysis and decision-making.

Embrace Excel’s transformative potential in your financial work and see your decision-making abilities reach impressive new levels. Excel mastery becomes more straightforward with Macabacus, enabling finance and investment banking excellence.