Case Study

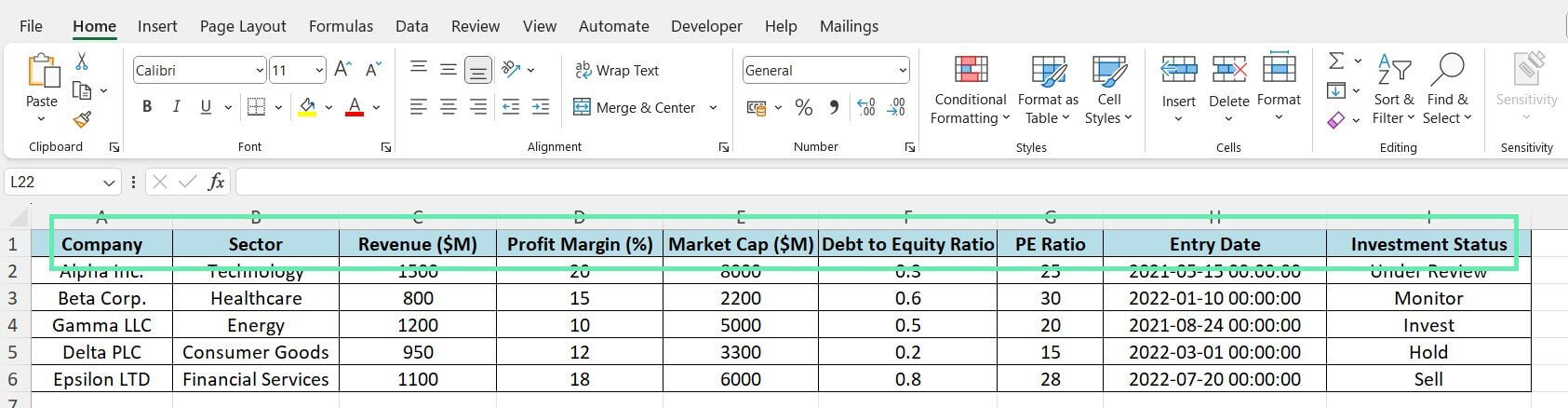

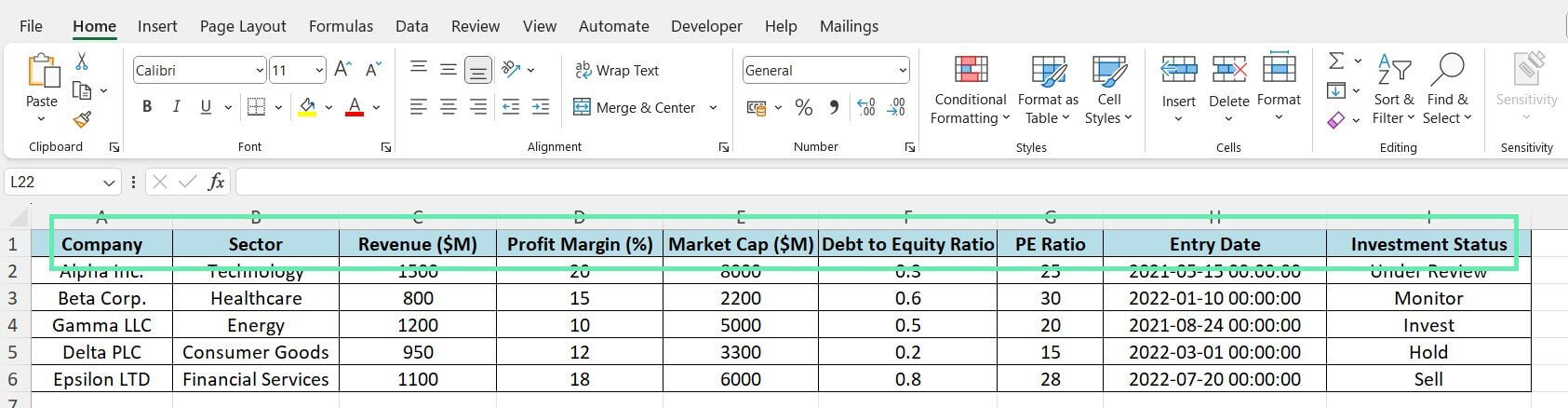

To illustrate the process of creating an investment memo from Excel data, let’s consider a practical case study using the provided dataset. The dataset may contain information on various companies, such as their sector, market capitalization, revenue, and profit margin.

Step 1: Organize the data in Excel by creating tables and defining meaningful names for specific data ranges.

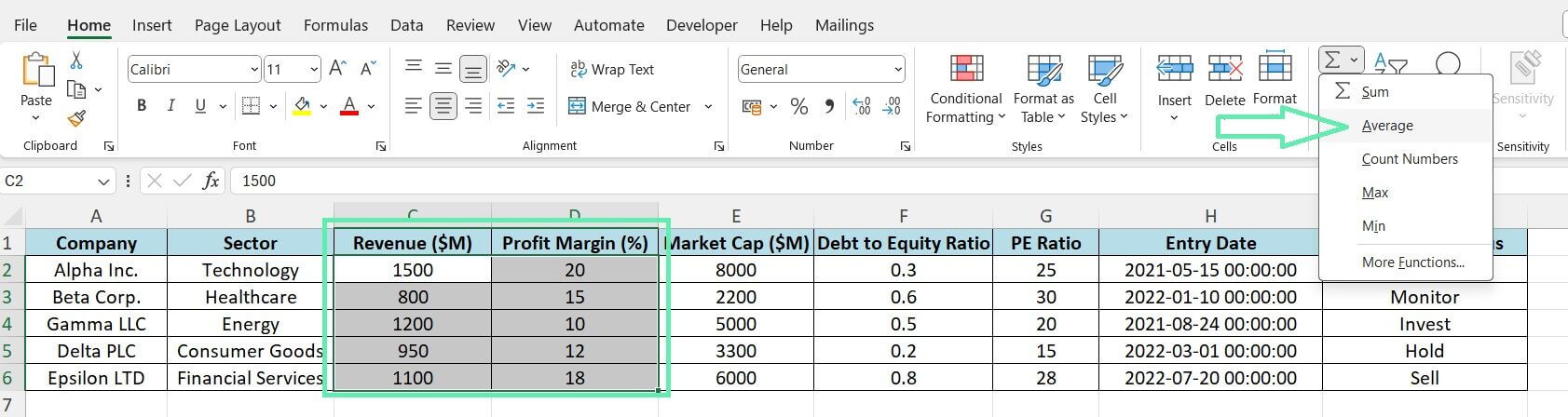

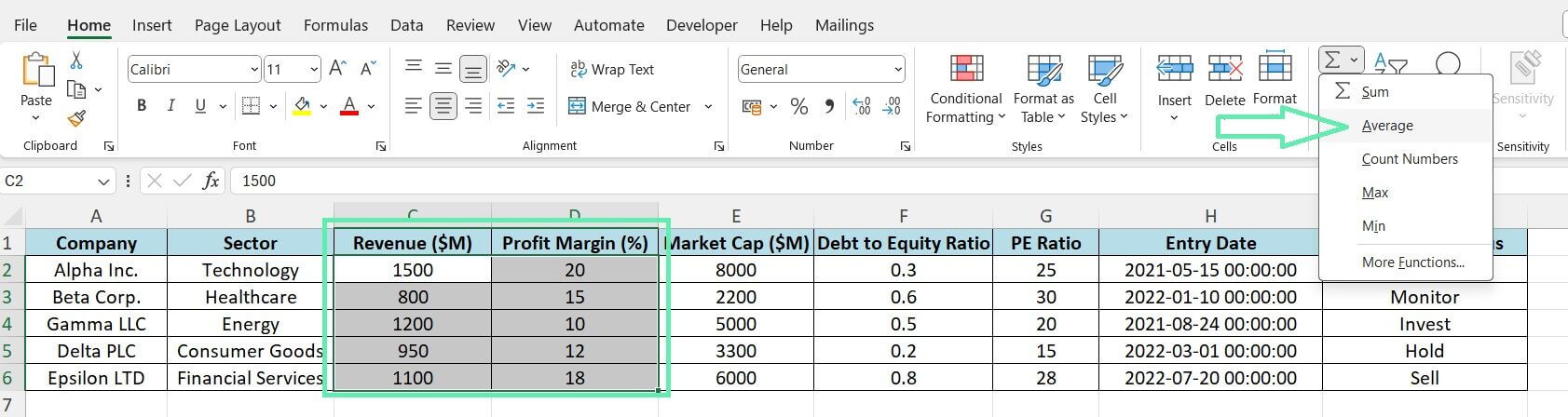

Step 2: Analyze the data using relevant Excel functions. For example, calculate each sector’s average revenue and profit margin using the AVERAGE function. Use PivotTables to summarize the market capitalization data by industry.

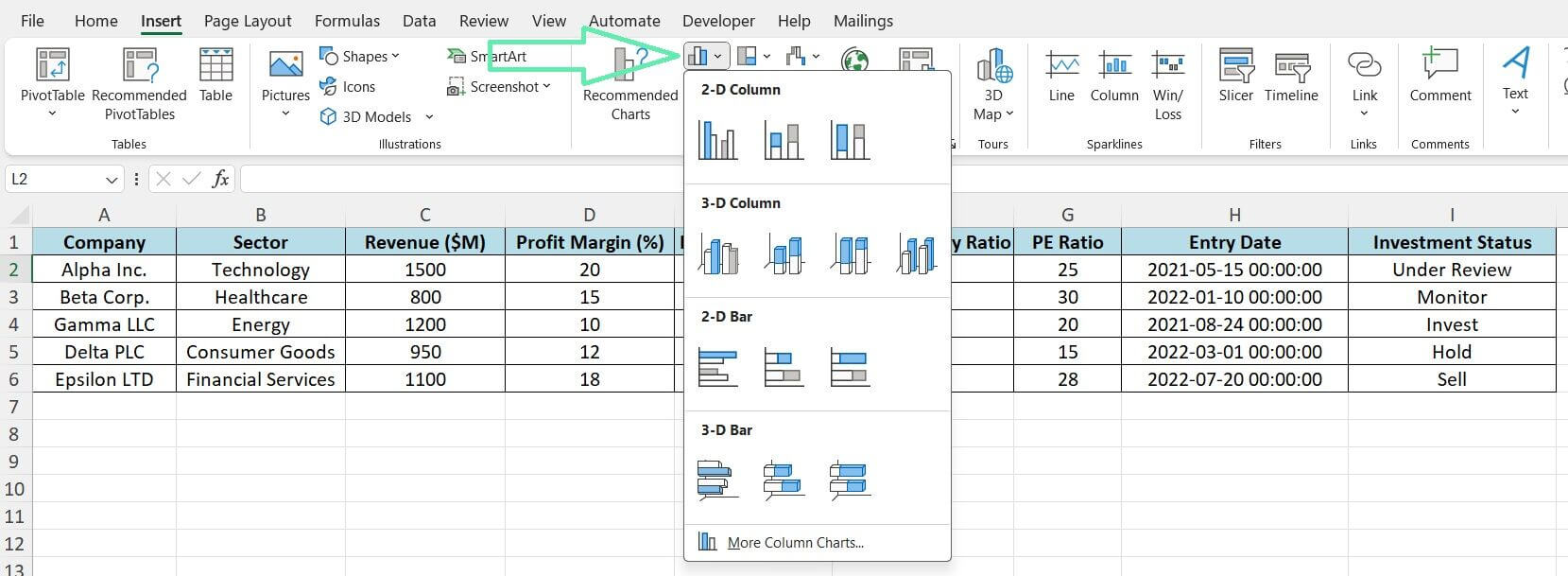

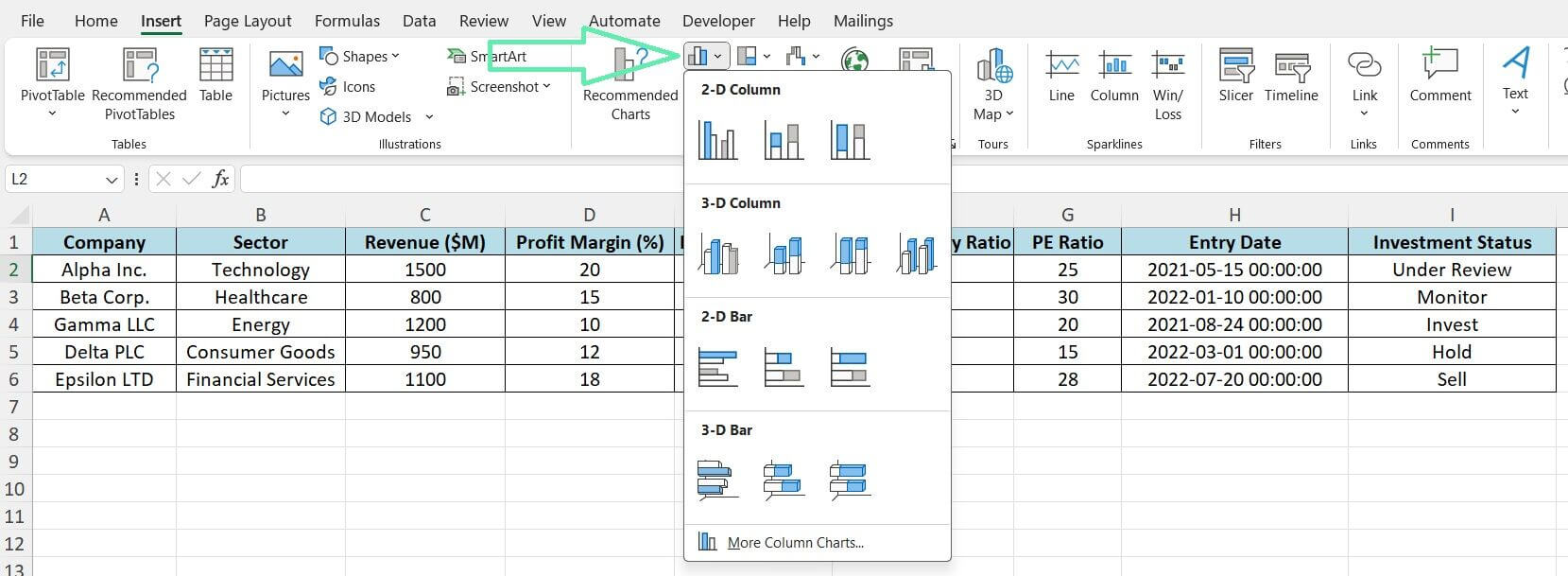

Step 3: Create visualizations to support the analysis. For example, create a bar chart comparing average profit margins across different sectors or a pie chart illustrating each company’s market share within a specific sector.

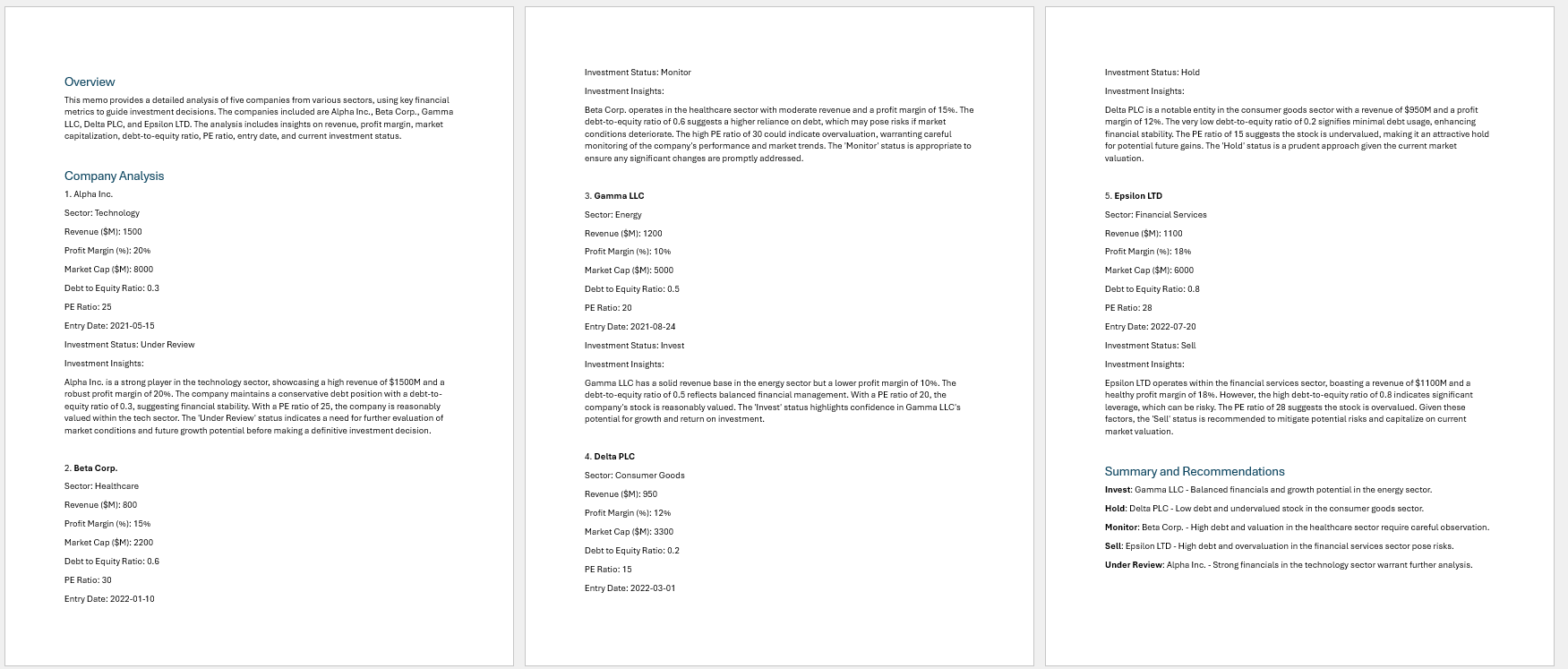

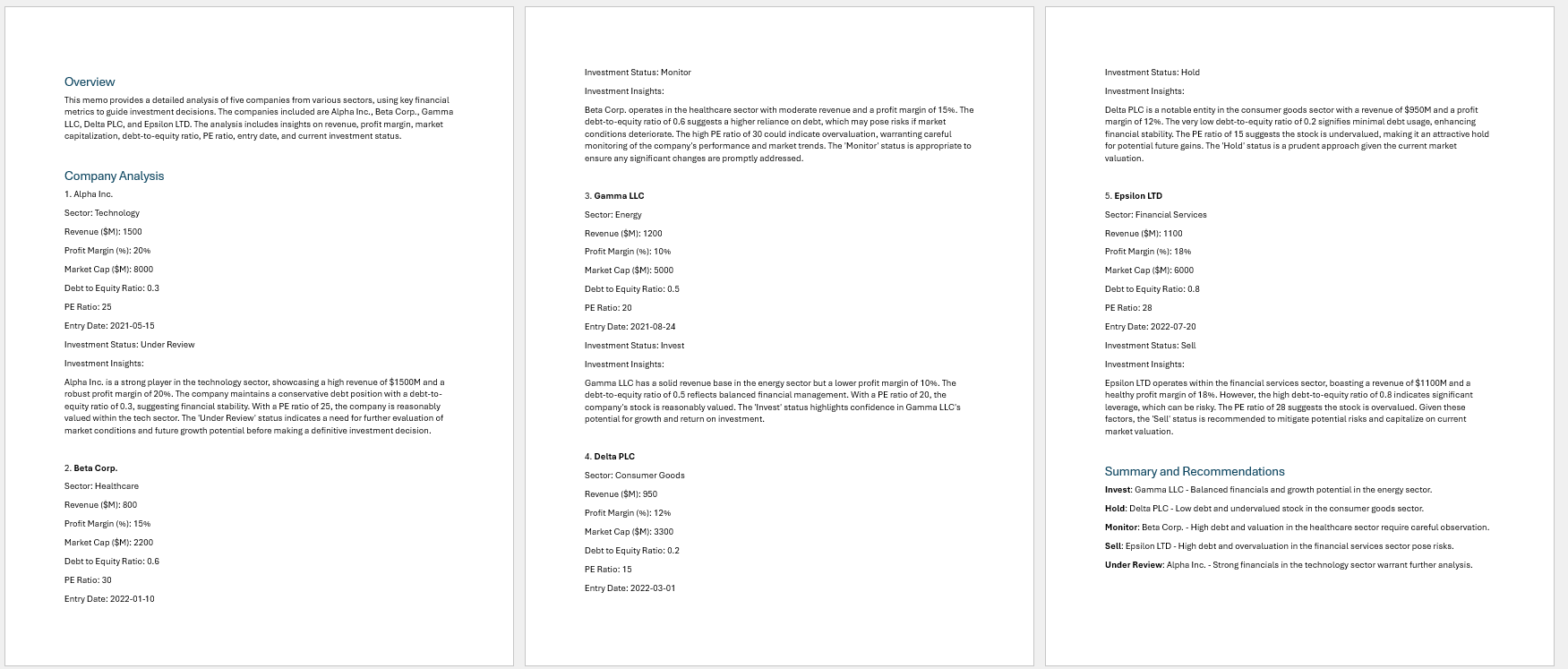

Step 4: Begin drafting the investment memo, incorporating the insights derived from the Excel analysis. Structure the memo with the critical components outlined in this blog post.

Step 5: Integrate the Excel data and visualizations into the memo, ensuring the links are established, and the visuals are clearly labeled and formatted.

Step 6: Conduct a thorough quality control review, verifying the financial calculations’ accuracy and the narrative’s clarity. Engage in peer reviews to gather feedback and make necessary revisions.

Step 7: Finalize the investment memo, ensuring it is well-structured, persuasive, and aligned with the expectations of the intended audience.

Conclusion

Creating a compelling investment memo from Excel data requires technical skills, financial acumen, and effective communication. Finance professionals use Excel for detailed financial analyses, data visualization, and insights. The insights assist decision-makers in evaluating potential investment opportunities.

To craft a successful investment memo, it is essential to follow a structured approach. We must collect, organize, and analyze data, create a well-structured memo, and manage versions effectively to ensure accuracy and reliability.

Finance professionals can enhance productivity and streamline processes using tools like Macabacus. Macabacus streamlines formatting, formula auditing, and integration across Excel, PowerPoint, and Word, saving time and improving collaboration for creating investment memos. Mastering complex financial data into clear, compelling narratives is crucial for finance professionals to communicate insights and drive organizational success.