Building Custom Error Checks for Finance

A. Error Detection with Excel Formulas

Excel offers a range of formulas for detecting and managing errors in financial data. Two handy functions are ISERROR and IFERROR.

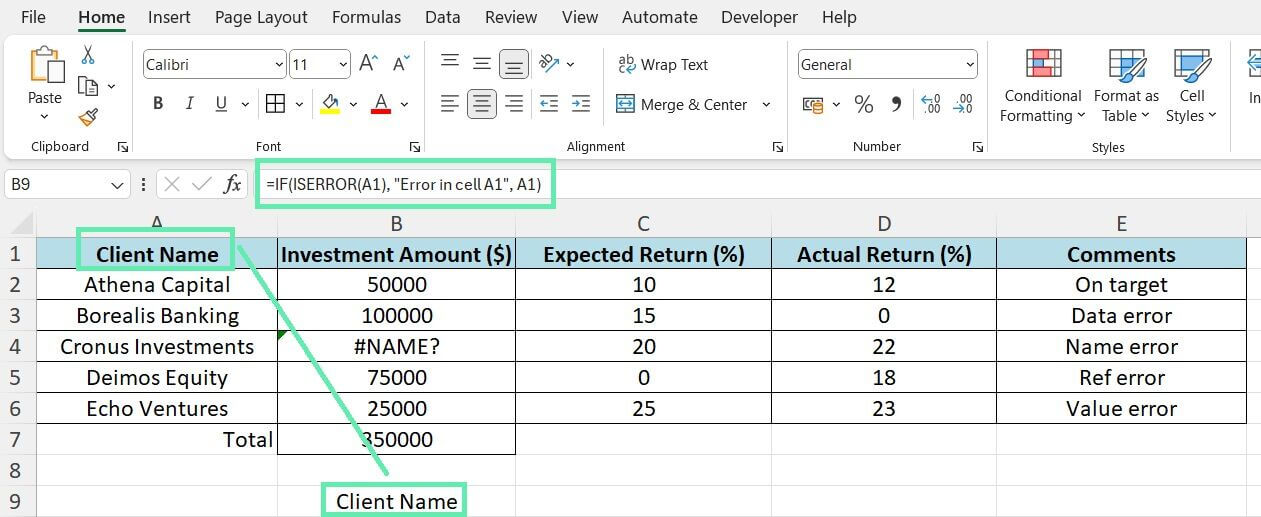

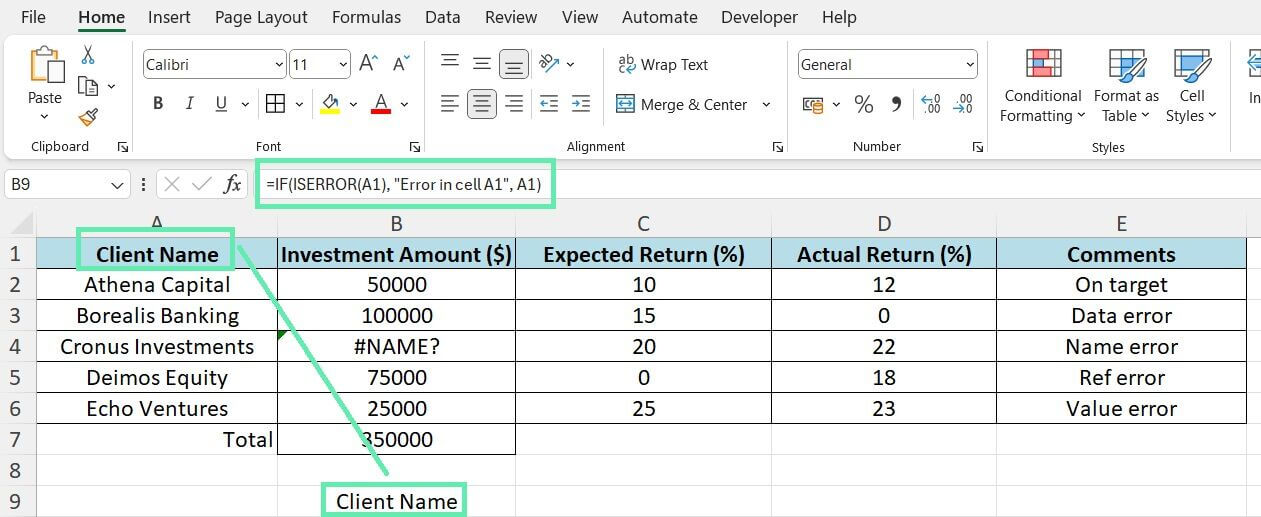

ISERROR returns TRUE if a cell has an error value and FALSE otherwise.

Use an IF statement for custom error messages or alternative calculations when an error is detected.

For example, the formula =IF(ISERROR(A1), “Error in cell A1”, A1) will return the value in cell A1 if it is not an error, or the message ‘Error in cell A’ if it is.

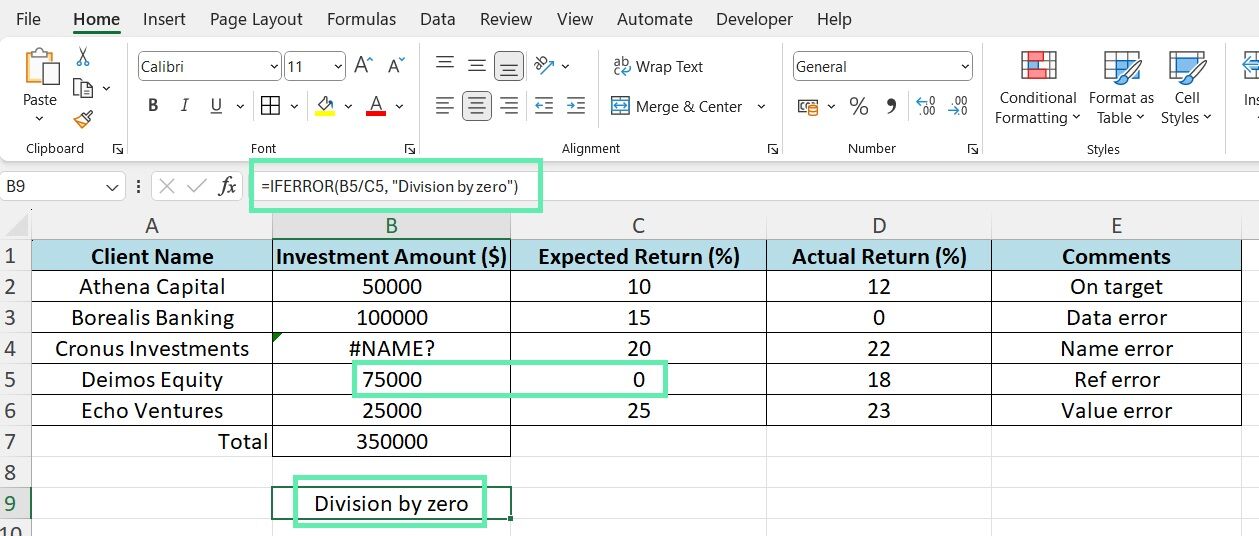

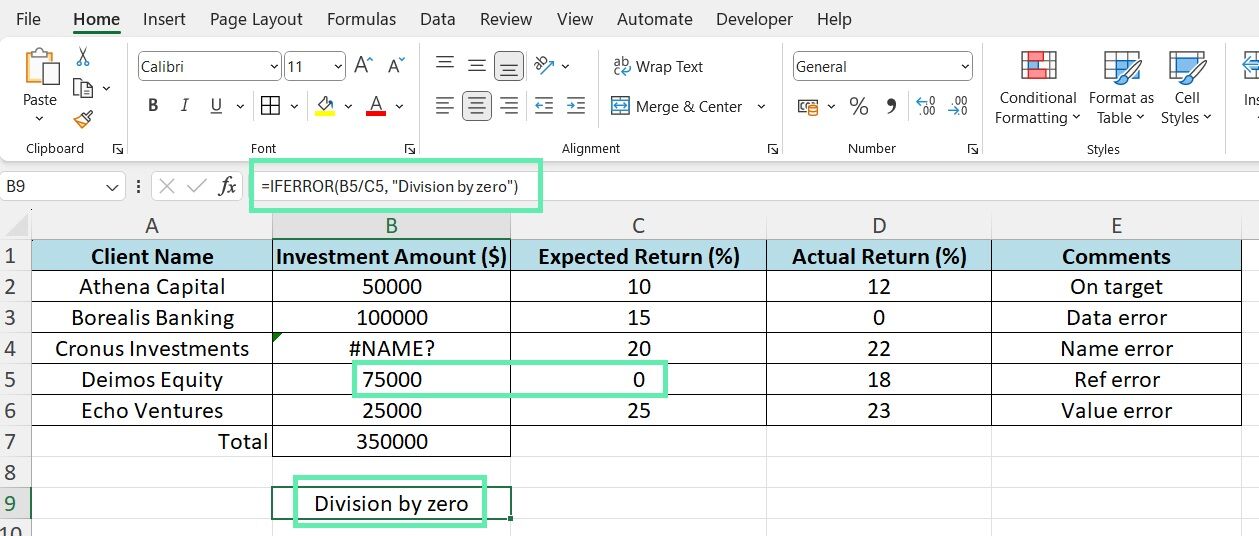

The IFERROR function simplifies the above process by allowing you to specify a value to return if the first argument results in an error. Using the IFERROR function, if C5 is zero, ‘Division by zero’ will be returned instead of an error message.

=IFERROR(B5/C5, “Division by zero”)

By incorporating these formulas into your financial model, you can effectively trap and handle errors, maintaining the accuracy of your calculations.

B. Custom Error Check Columns in Investment Tracking

Maintaining consistent and accurate data when tracking investments and their returns is crucial. You can achieve this by creating custom error check columns that verify the data’s integrity.

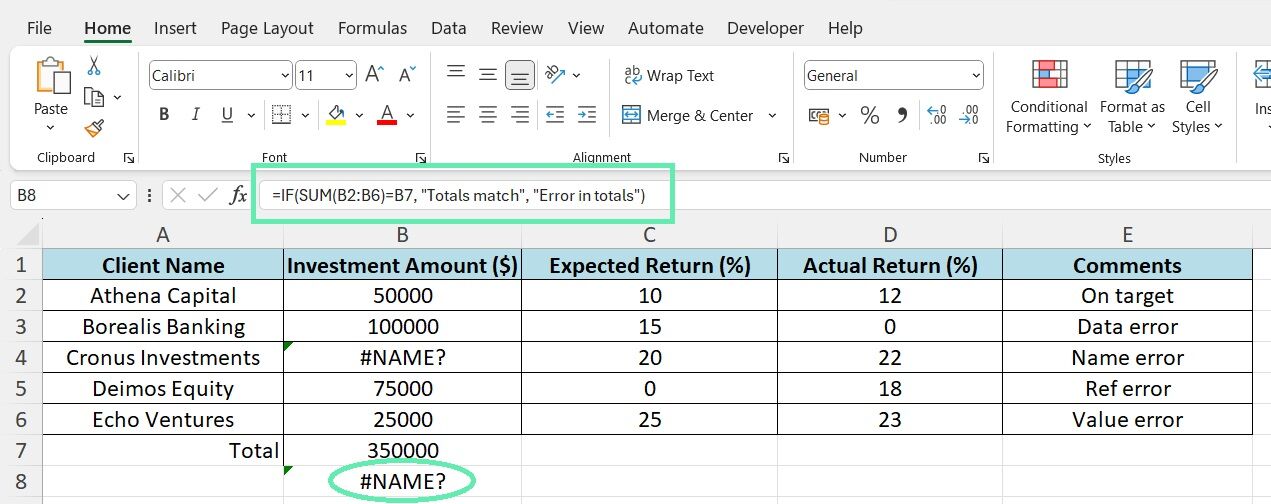

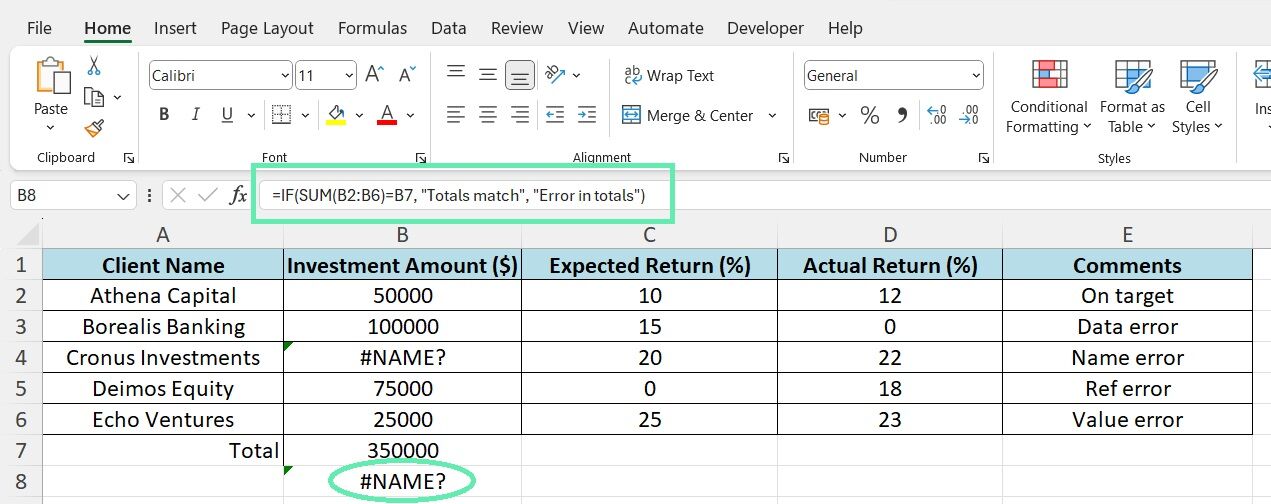

For example, you can make a column that calculates the total investment amount by summing the individual investment entries and then comparing this total to a manually entered expected total using an IF statement.

The formula =IF(SUM(B2:B6)=B7, “Totals match”, “Error in totals”) will return ‘Totals match’ if the sum of the investment entries in B2 – B6 matches the expected total in cell B7, or ‘Error in totals’ if there is a discrepancy.

Advanced Error Checking Techniques for Finance Professionals

A. Leveraging VBA for Automated Error Handling

Although built-in Excel formulas provide a solid foundation for error trapping, more complex financial models may require the power and flexibility of VBA (Visual Basic for Applications) to automate error-handling processes. VBA enables you to create custom scripts to detect particular conditions, display error messages, and rectify mistakes.

For example, a simple VBA script can loop through a range of cells, checking each value against a set of criteria and flagging any cells that fail to meet the said criteria. It can significantly reduce time and effort compared to manually checking cells, especially for large datasets.

Additionally, custom error-handling routines can be created using VBA to manage specific errors in financial models, providing a more sophisticated level of error management.

B. Employing Array Formulas for Complex Financial Analysis

Array formulas are another powerful tool in the Excel arsenal that can help minimize errors in complex financial analyses. Unlike regular formulas that calculate individual cells, array formulas operate on multiple cells as a single entity. It allows for more complex, error-resistant calculations across entire investment portfolios.

To calculate a portfolio’s weighted average return, you can use an array formula that multiplies each investment’s return by its weight, sums the results, and divides by the total weight.

Array formulas reduce the risk of errors when linking multiple formulas across different cells and ranges.

Best Practices for Error Management in Financial Modeling

1. Establishing Routine Audits

Implementing error-trapping techniques is essential to maintaining the accuracy of your financial models. Still, it is equally important to establish a routine auditing process to ensure the techniques are applied consistently and effectively. Regular audits should involve:

- Systematically reviewing your Excel spreadsheets

- Checking for common errors

- Verifying the accuracy of formulas and calculations

- Ensuring that error-trapping measures function as intended

Depending on your organization’s size and complexity, a dedicated team member or an external auditor can oversee the above process. Regular audits in financial modeling proactively catch errors before they impact decisions.

2. Excel Training for Finance Professionals

To ensure financial model accuracy, provide ongoing training for your finance team to master Excel’s error trapping. Use online courses, workshops, and certifications to update your team on Excel techniques and best practices. Excel training for finance professionals ensures accurate financial models for informed decision-making.

Conclusion

In the dynamic and exacting world of investment banking, managing and preventing errors in Excel is vital. Possessing effective error-trapping skills can be a competitive advantage in financial modeling success. You can use Excel custom checks and advanced techniques like VBA and array formulas to improve the accuracy of your financial analysis. Regular audits and Excel training cultivate precision and excellence in finance teams.

At Macabacus, we understand the critical nature of such challenges. Our tools simplify financial documentation, increase productivity, and ensure consistency across different Microsoft Office applications. Macabacus provides you with the right tools to meet the high standards demanded by your industry, whether you are refining financial models or preparing complex presentations. Embrace Macabacus and take a significant step towards achieving excellence.