Step-by-Step Guide to Flatten Formulas Using Copy + Paste Values

Since we now know the reasons behind the formulas’ importance in investment banking, let us go ahead and examine how flattening formulas is done, step by step. The most direct way of changing formulas into values entails employing the function of Copy and Paste Values, which is found in Microsoft Excel.

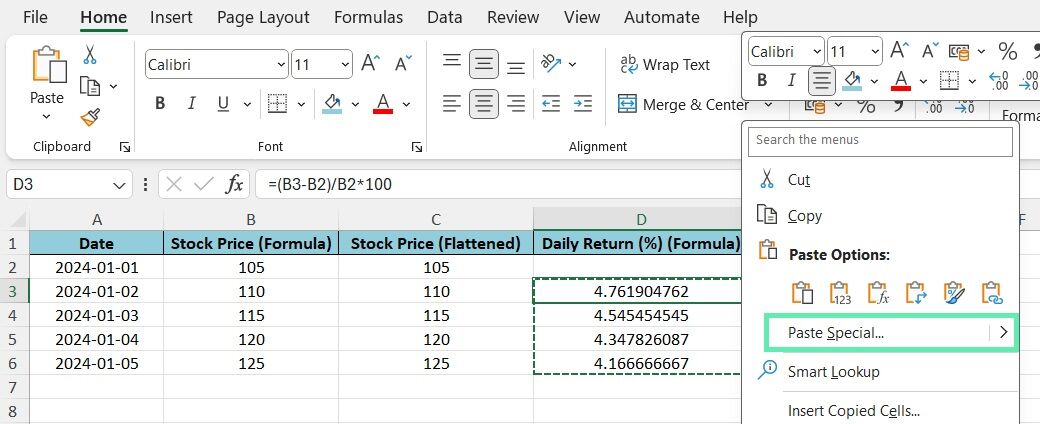

Step 1: Select the cells with formulas you want to flatten.

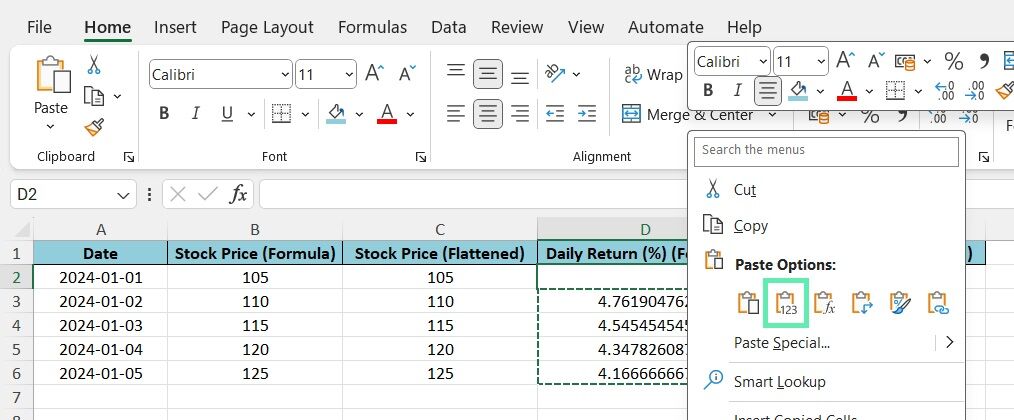

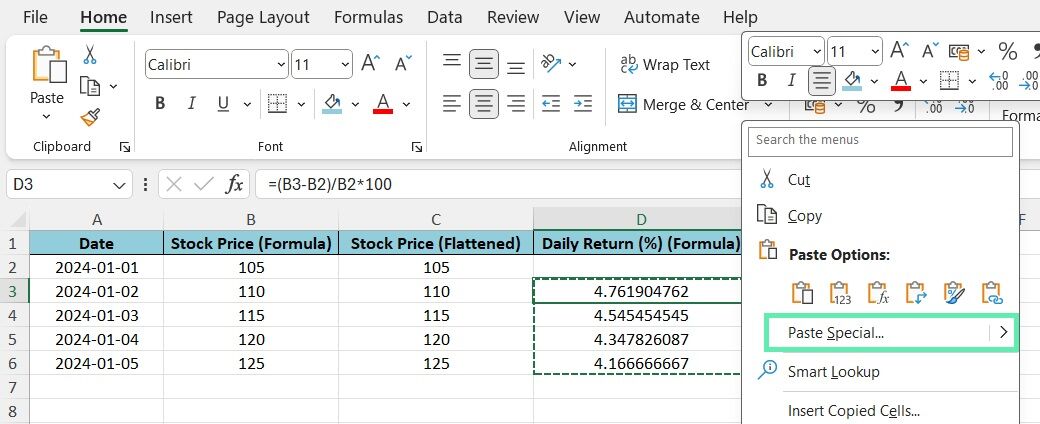

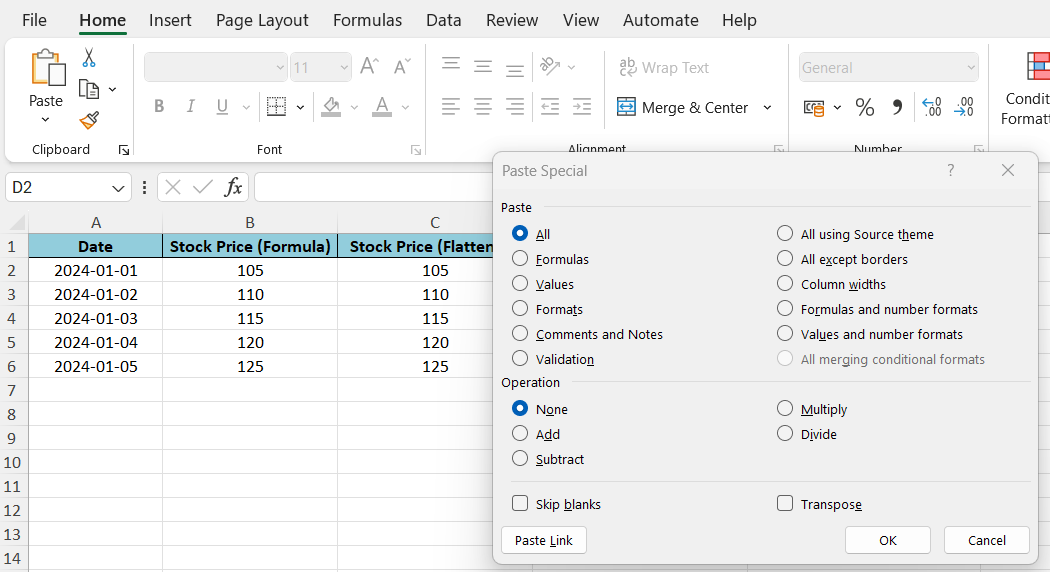

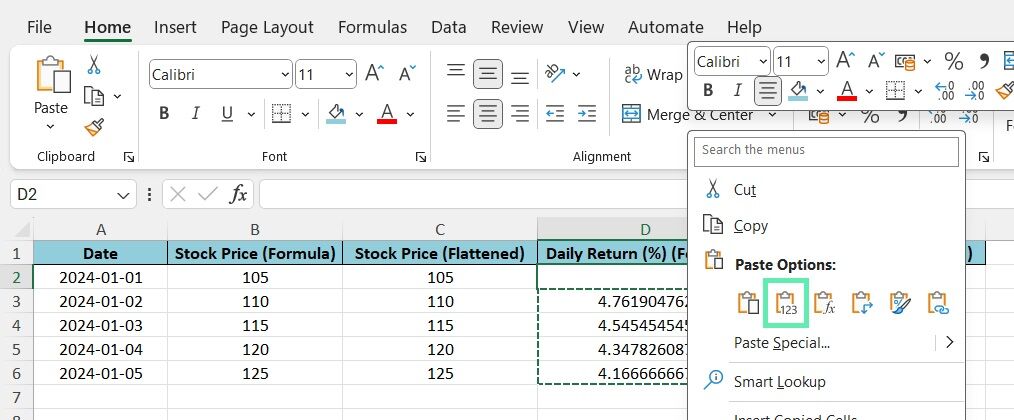

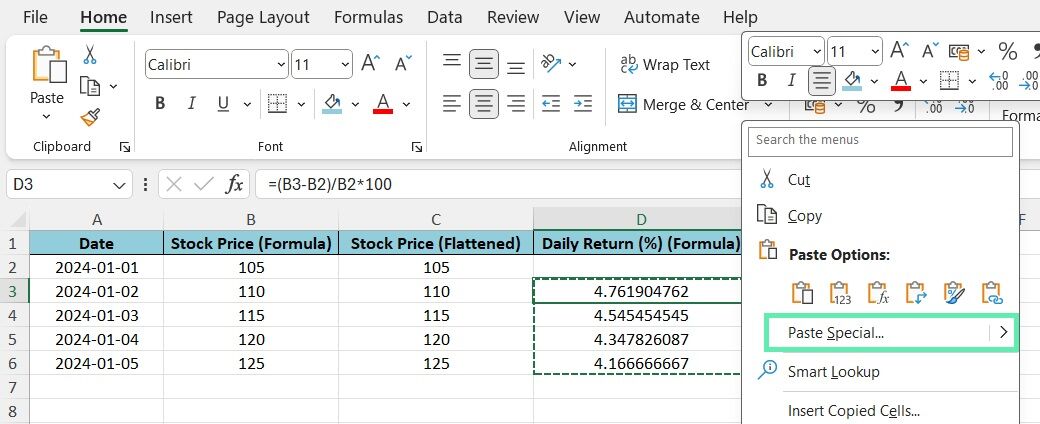

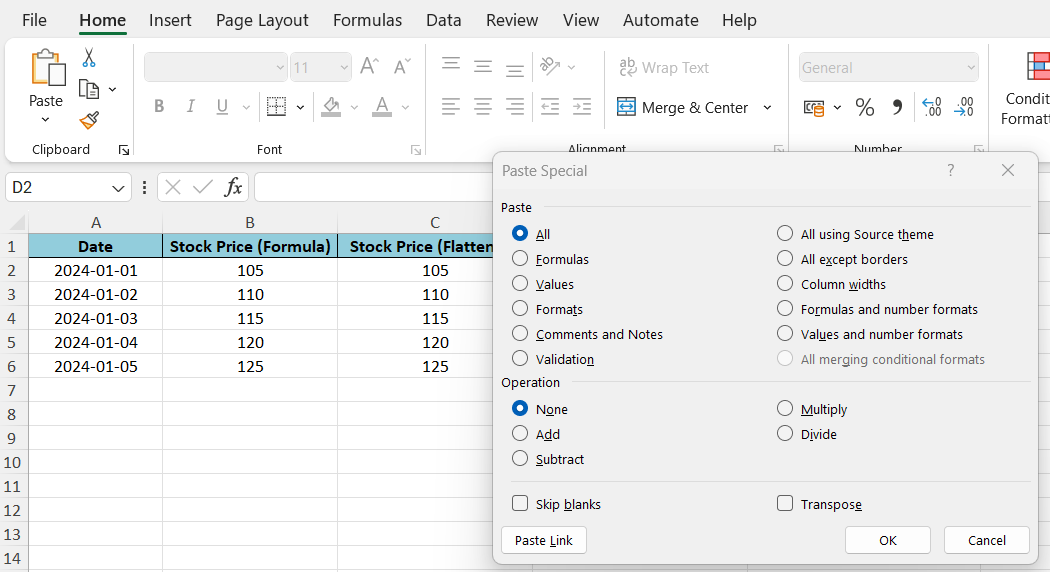

Step 2: Copy the cells. Right-click the first cell and pick ‘Paste Values’. Or, press Ctrl + Alt + V (Command + Option + V on a Mac), choose ‘Values’, and click ‘OK’.

It is essential to double-check that the formulas were successfully converted to values. You can do so by selecting a cell and verifying that the formula bar displays the actual value rather than the formula.

Keyboard Shortcuts for Efficient Formula Flattening

While the Copy and Paste Values method is effective, keyboard shortcuts really speed things up, especially with large datasets. Here are some key shortcuts to remember:

- Ctrl + C (or Command + C on a Mac): To copy the selected cells

- Ctrl + Alt + V (or Command + Option + V on a Mac): To open the Paste Special dialog box

- Alt + E + S + V (or Option + E + S + V on a Mac): To paste values directly without opening the dialog box

Add the above shortcuts to your daily tasks to save time and work smoothly.

Advanced Tips on Copying and Pasting Values

When you need to convert formulas to plain numbers, copying and pasting values is the go-to technique. However, Excel comes with extra features that give you better command over the process.

With ‘Paste Special‘, you can choose to paste only certain parts of your copied data, like formats, formulas, or just the values. This is especially handy in intricate financial models where keeping the formatting is crucial.

For investment bankers dealing with extensive datasets and repetitive flattening tasks, automating the process using VBA macros can be a game-changer. By creating custom macros, you can streamline the flattening process and apply it to multiple sheets or workbooks with just a few clicks. This not only saves time but also reduces the risk of human error.

Common Mistakes in Formula Flattening and How to Avoid Them

Even though it might seem simple, the act of flattening formulas comes with pitfalls of its own. One typical example entails replacement instead of retaining the standard formulas during the flattening process. It is vital to keep a copy of your spreadsheet in case you want to go back on the flattening process. The original version can always be retrieved in case anything goes south.

Another potential pitfall is failing to flatten all the necessary formulas. In complex financial models, formulas may be spread across multiple sheets or hidden in inconspicuous cells.

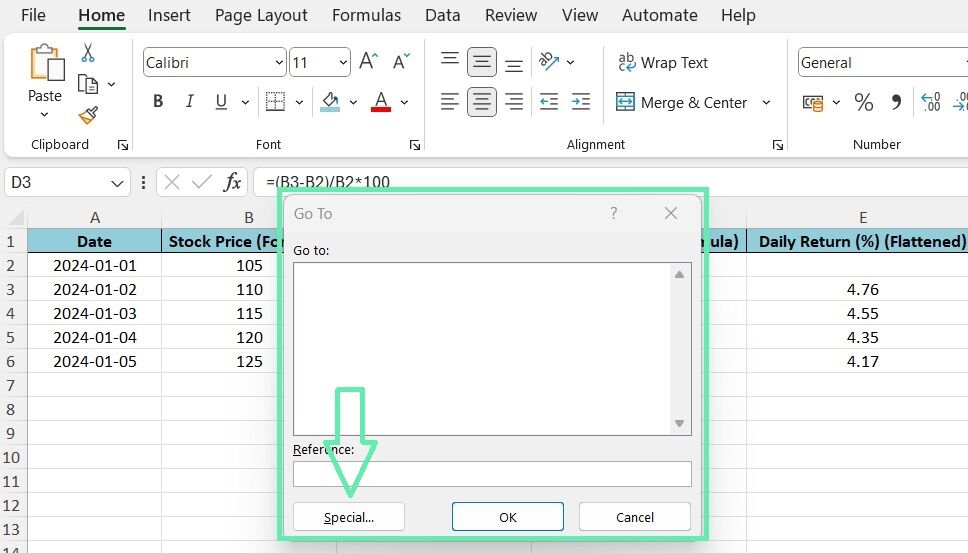

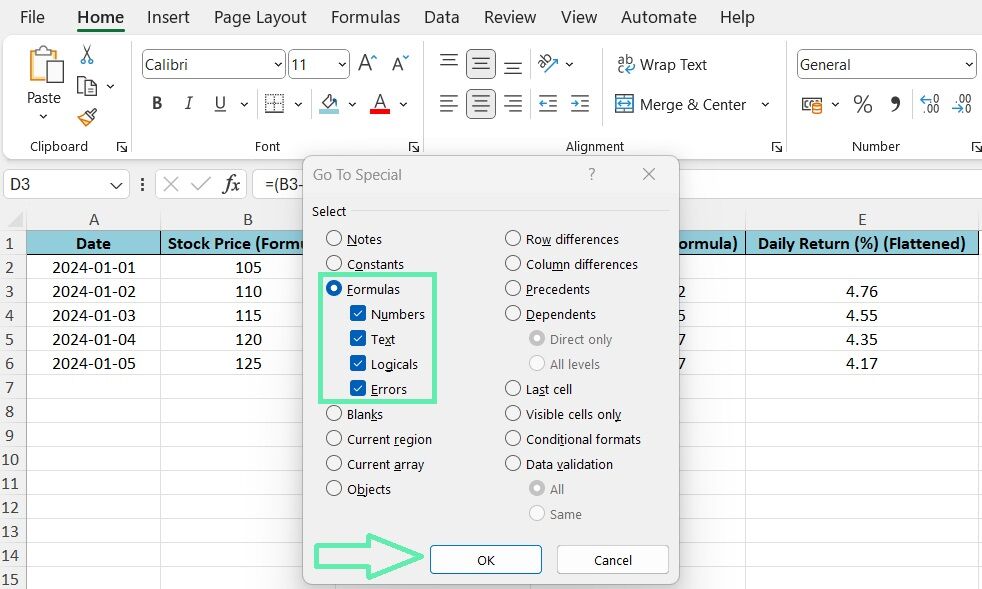

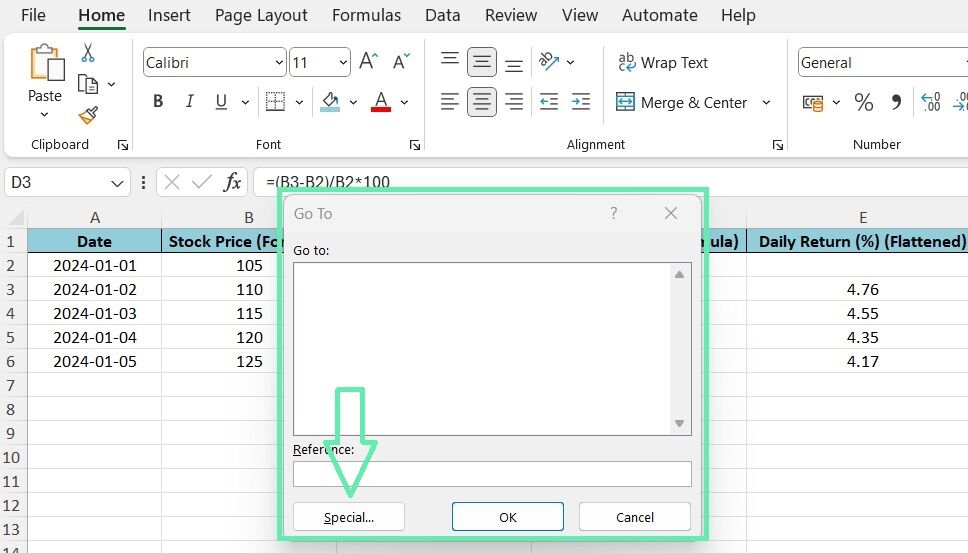

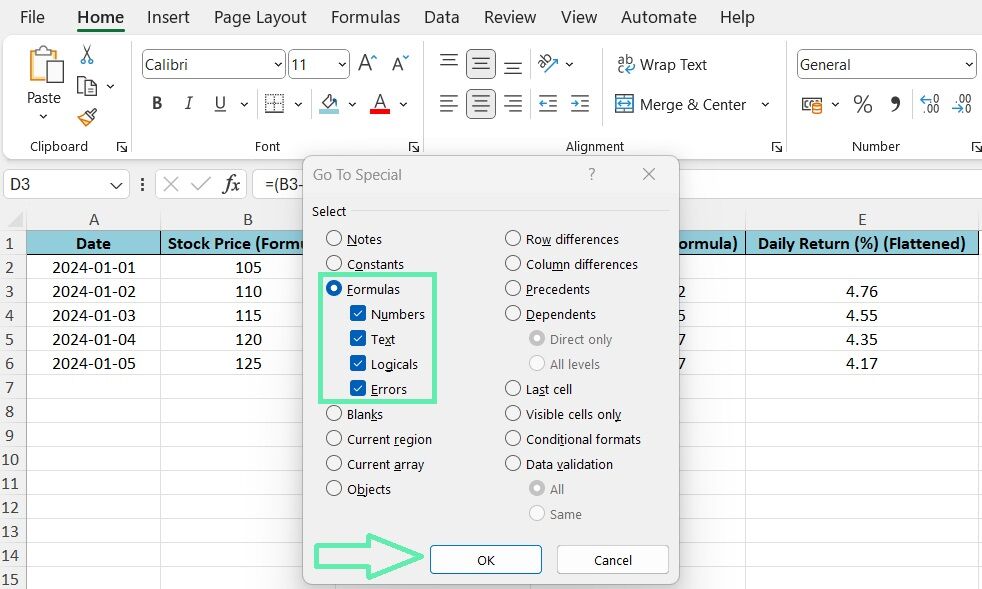

To ensure that you’ve flattened all the required formulas, it is a good practice to use the ‘Go To Special’ function in Excel (Ctrl + G or F5, then select ‘Formulas’) to highlight all the cells containing formulas in the worksheet. This visual aid helps you identify any missed formulas and ensures a thorough flattening process.

Implementing Flattening Formulas in Investment Analysis

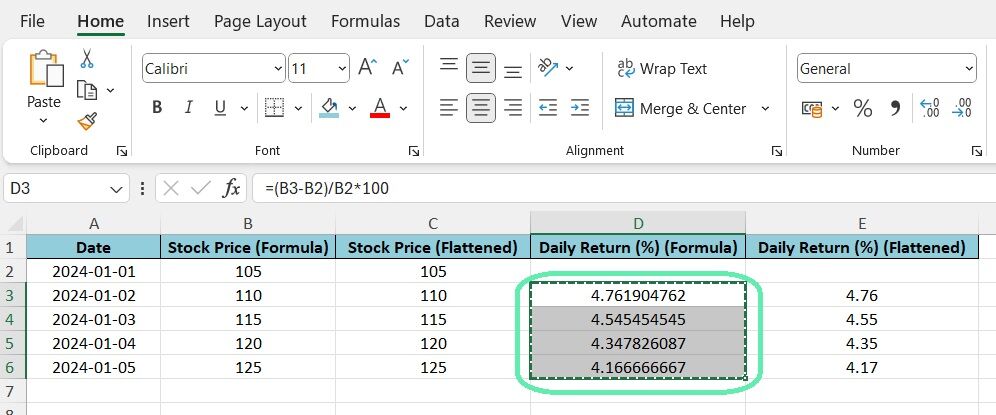

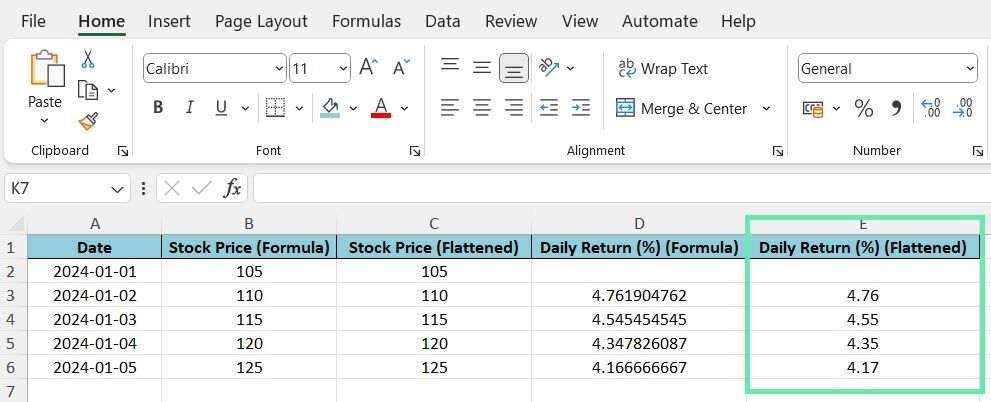

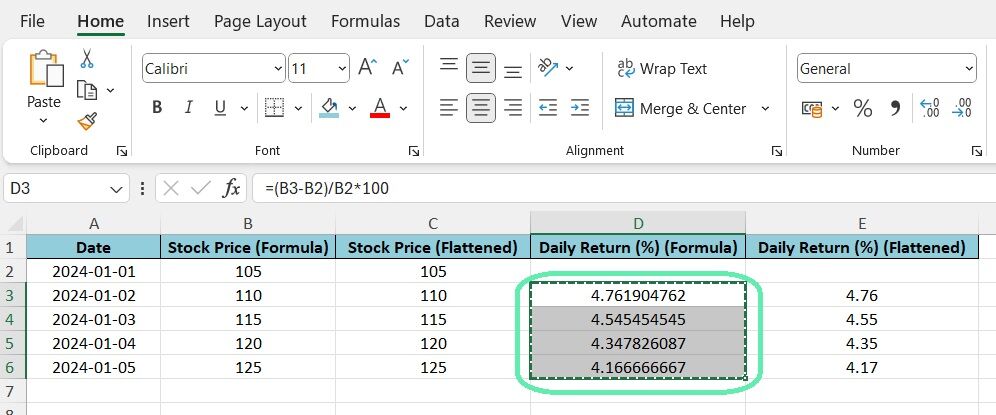

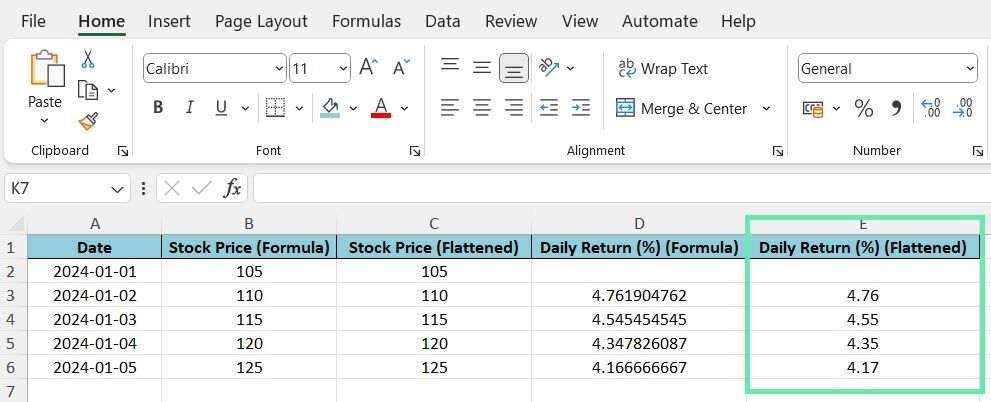

To illustrate the practical application of flattening formulas in investment banking, let’s consider a case study involving stock price analysis. Suppose you have a dataset containing daily stock prices and corresponding returns for a portfolio of companies. You use formulas to calculate the daily returns based on the stock prices.

Before sharing the analysis with clients, you need to flatten the formulas to ensure the integrity of the data and ease of use. By following the step-by-step guide outlined earlier, you can efficiently convert the return formulas to static values. It not only provides a cleaner presentation of the data but also allows clients to perform further analysis without the risk of accidentally altering the underlying formulas.

After flattening the formulas, you can compare the dataset before and after the process to verify that the values remain unchanged.

Conclusion

Mastering Excel shortcuts is not just a convenience—it’s a necessity for boosting efficiency and ensuring precise financial analysis and modeling. Flattening formulas, in particular, is an indispensable technique for an investment banker or any other Excel user. It allows you to convert dynamic formulas into static values, thereby preserving data integrity, simplifying the sharing of financial models, and streamlining your workflow.

Throughout this blog post, we’ve delved into the significance of flattening formulas in the realm of investment banking, offered a detailed guide on how to do it, and shared some expert tips and pitfalls to avoid. By adopting the above methods and making keyboard shortcuts a part of your daily routine, you can elevate your Excel prowess and thrive in your investment banking career.

This is where Macabacus shines. It’s a platform crafted to boost productivity in Microsoft Office, tailored specifically for teams in finance and banking. So, next time you’re knee-deep in a complex financial model, remember the power of flattening formulas—and consider how tools like Macabacus can boost your efficiency and accuracy. With these strategies in your arsenal, you’ll be well-equipped to face any investment banking challenge head-on.