Advanced Techniques for Searching Formatting in Financial Models

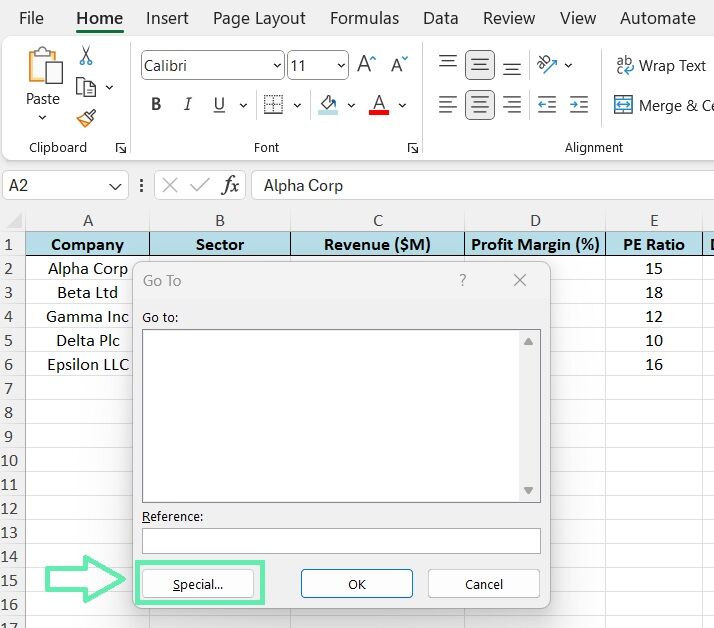

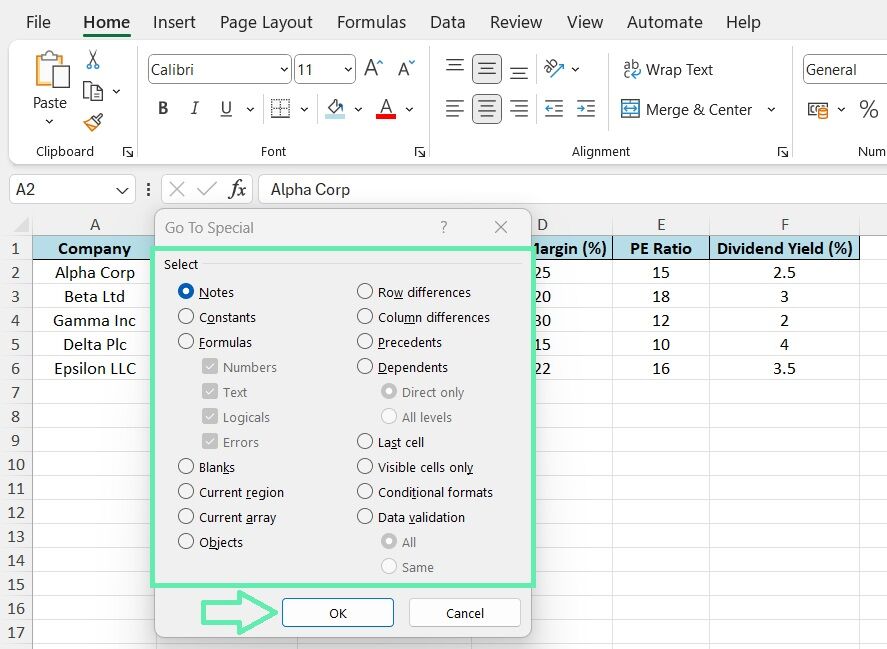

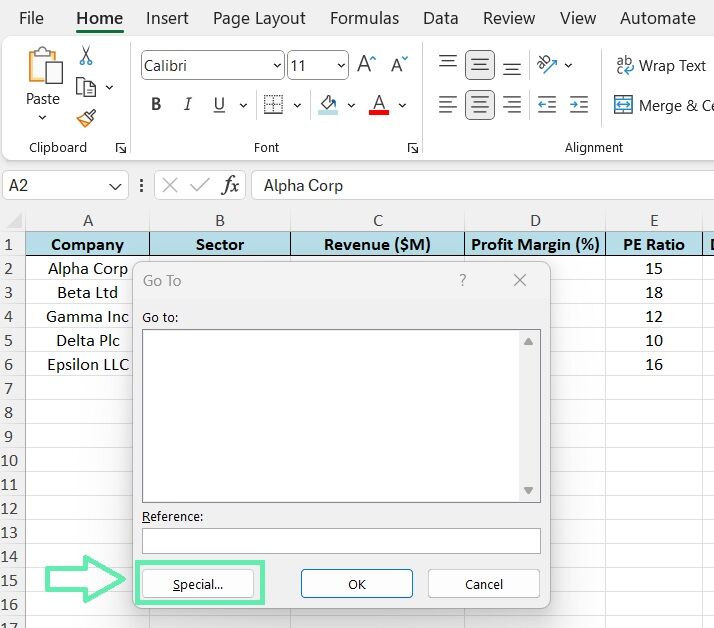

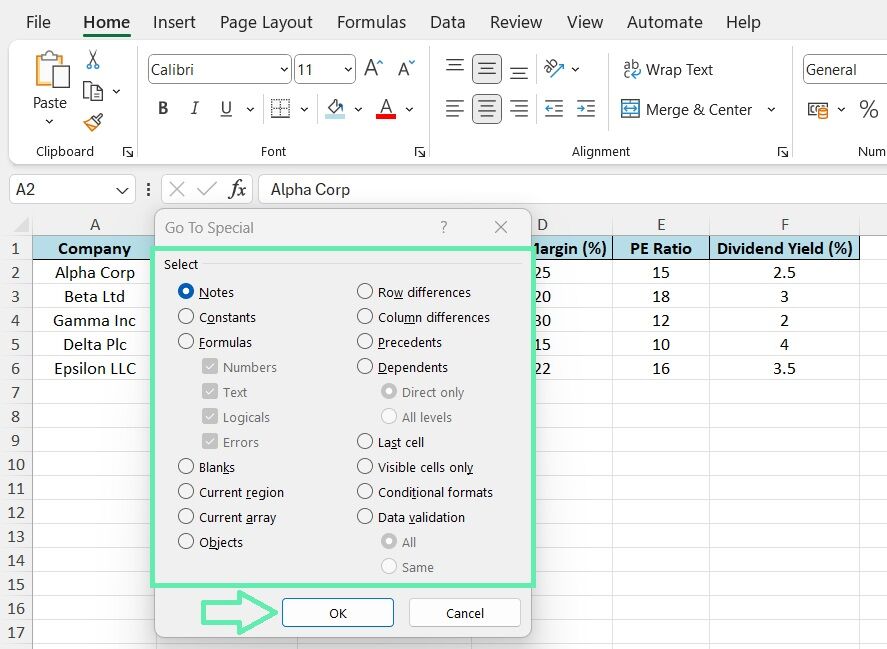

For more complex financial models and reports, Excel offers advanced features for searching and manipulating cell formatting. One such feature is the Go To Special tool, which allows you to select cells based on specific criteria, including formatting.

To utilize the said feature, press Ctrl+G to launch the Go To dialog box and then click on the ‘Special‘ button. It will allow you to select cells based on different formatting criteria, including cells with a particular font color, border, or number format.

Another advanced technique is writing simple macros to automate the process of searching for and highlighting cells with specific formatting. Macros are essentially a series of recorded or programmed actions that can be executed with a single click.

By creating a macro that searches for specific formatting criteria and applies a distinct highlight color, finance professionals can quickly identify and analyze relevant data points in their financial models.

Real-World Applications in Finance

The ability to efficiently search for cell formatting in Excel is invaluable for investment bankers and finance professionals. Let’s consider a few real-world scenarios where such a skill can be applied:

Identifying Trends

Suppose an investment banker is analyzing a company’s financial statements over multiple years. By applying consistent formatting to key metrics such as revenue, profit margins, and cash flow, they can quickly identify trends and patterns using formatting search techniques.

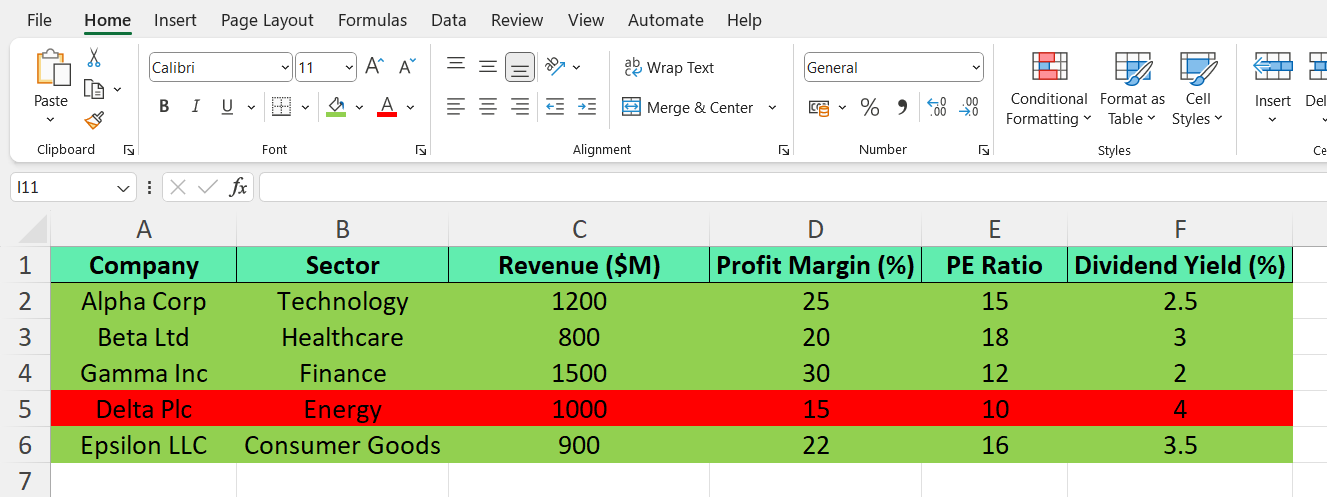

For example, by searching for cells with a green background, the banker can highlight years of positive growth, while red backgrounds may indicate periods of decline.

Risk Assessment

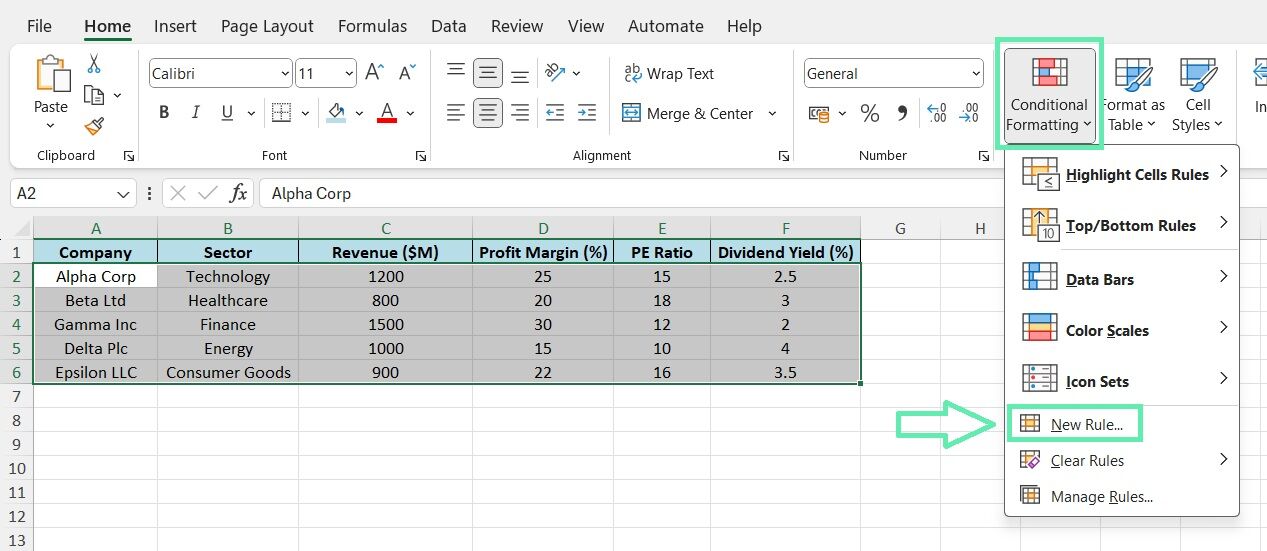

During investment evaluation, bankers can use risk assessment techniques to identify investments with significant risks. By applying conditional formatting in spreadsheets, bankers can highlight investments that exceed predefined risk levels, such as high debt ratios or insufficient liquidity. It allows them to easily identify potential issues and make informed decisions regarding the potential success of the investment opportunity.

Comparative Analysis

When comparing multiple companies or investment options, consistent formatting is crucial to accurate analysis. By standardizing the formatting of key financial metrics across different datasets, an investment banker can use formatting search techniques to quickly locate and compare specific data points. It can help in identifying the best-performing companies or the most attractive investment opportunities based on predefined criteria.

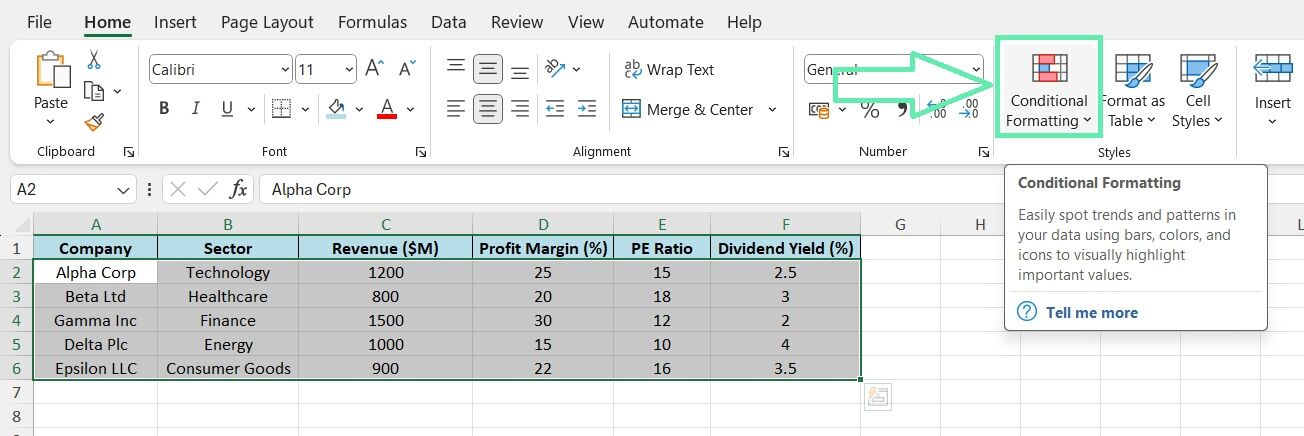

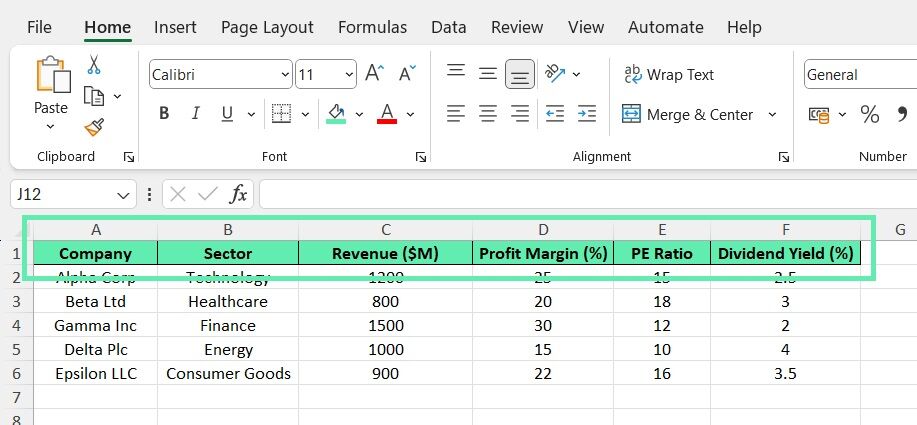

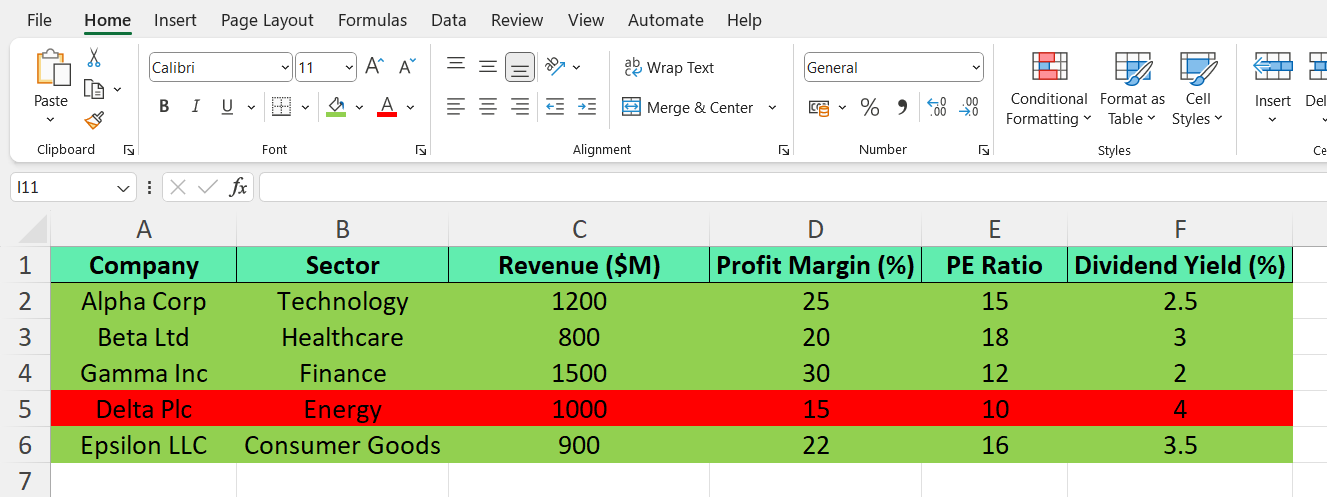

Practice Dataset for Investment Bankers

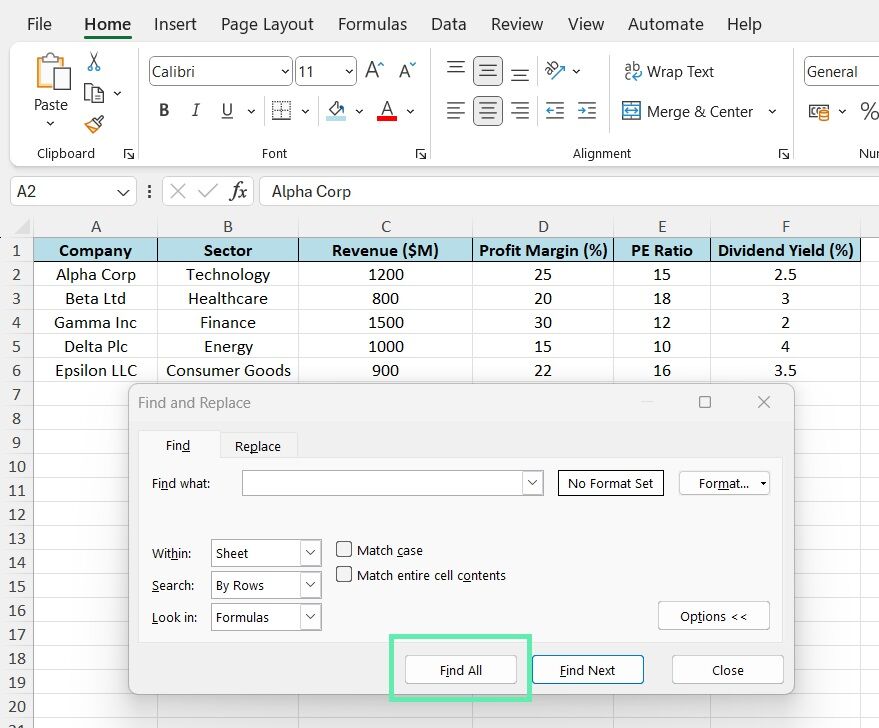

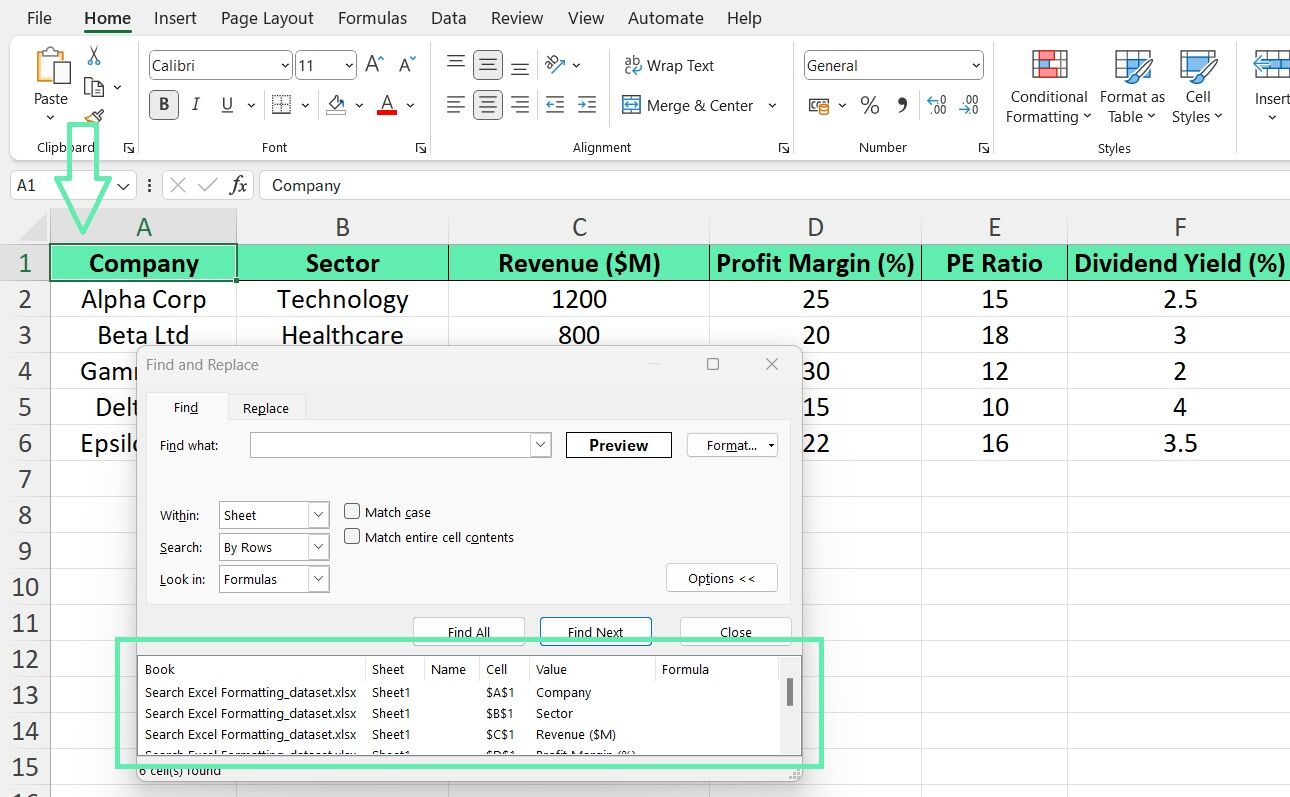

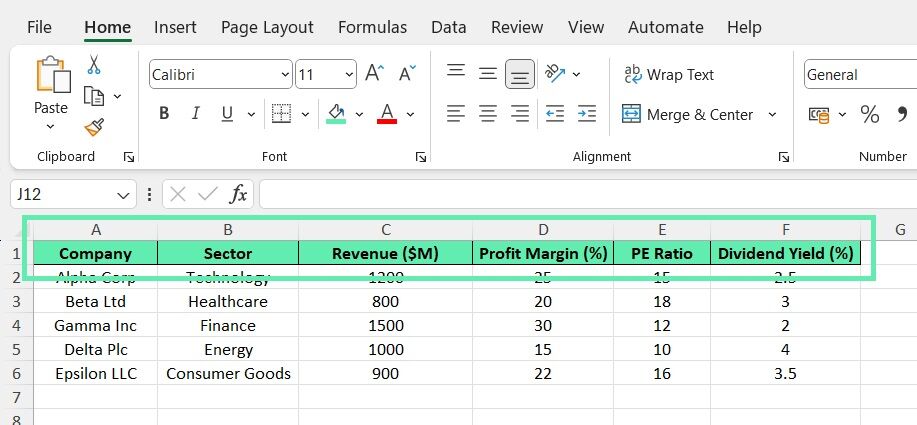

To help investment bankers practice and master the techniques discussed in this blog post, we created a sample dataset containing financial information on various companies. The dataset includes details such as company name, sector, revenue, profit margin, price-to-earnings (PE) ratio, and dividend yield.

1. Apply consistent formatting to the header row, such as bold font and a distinct background color.

2. Use conditional formatting to highlight companies with profit margins above a certain threshold (e.g., 20%) in green and those below the threshold in red.

3. Apply a number format to the PE ratio column to display the values with two decimal places.

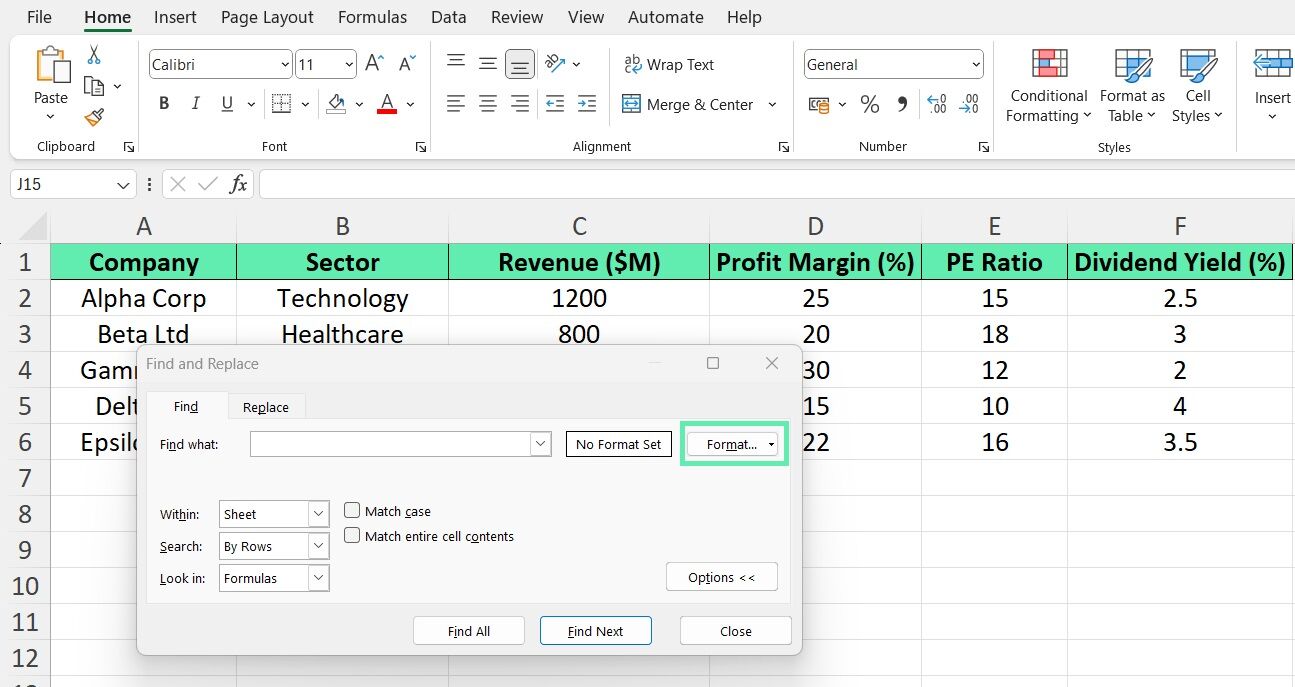

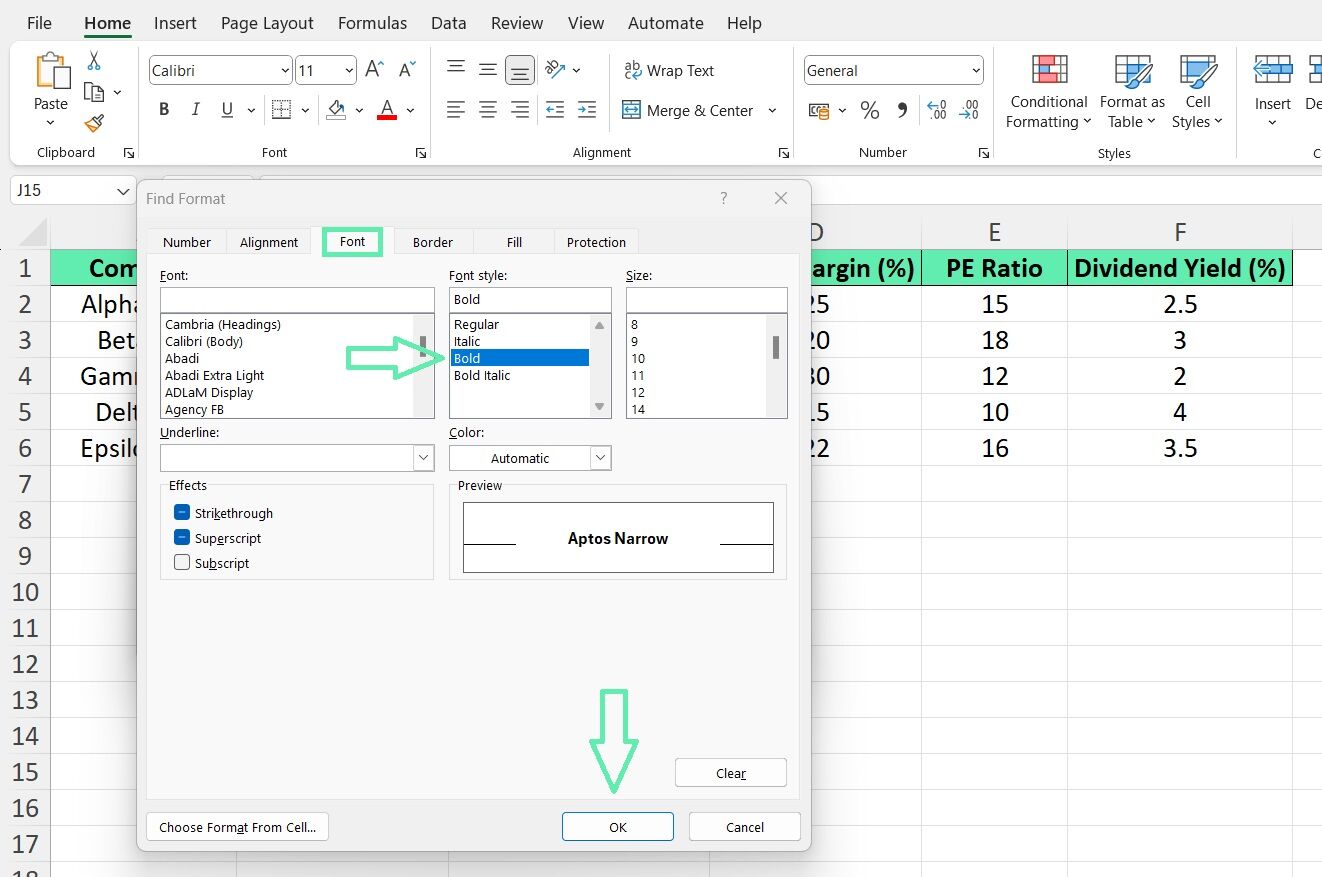

4. Use the Find and Replace feature to search for cells with a specific font color or background shade and navigate through the results.

5. Create a simple macro to automatically highlight cells that meet specific criteria, such as companies with a dividend yield higher than 5%.

By practicing the above techniques on the sample dataset, investment bankers can familiarize themselves with the various formatting search tools and apply them efficiently in their real-world financial analysis and reporting tasks.

Conclusion

Harnessing the power of cell formatting search techniques with the help of Macabacus allows finance professionals and investment bankers to pinpoint and examine specific patterns in large datasets efficiently. It enables them to uncover trends, evaluate risks, and make well-informed investment decisions.

Integrating the said techniques into their workflows enhances the clarity and readability of their financial reports, facilitating effective communication with stakeholders and yielding improved outcomes.

For finance professionals seeking to enhance their Excel proficiency, practicing various search techniques is essential. By experimenting with the above sample dataset and exploring various formatting options, you can see the transformative impact of such tools on your financial analysis and reporting capabilities. To learn more, check out Macabacus.