Why Banking and Finance Need a Purpose-Built DAM Platform

Banking and finance are unlike other industries. You’re dealing with live deals, sensitive client information, and a ton of regulatory oversight. The wrong software or a sloppy implementation could put more than efficiency at risk.

A strong brand asset management system should:

- Use enterprise-grade security to protect confidential information

- Enforce brand standards across every client-facing deliverable

- Scale across even large teams with no loss of control, and the ability to manage user access

- Make it easy for your employees to find and insert digital assets

- Integrate workflows directly into your asset management and asset access processes

Without those guardrails, you’re facing inefficiency, brand dilution, and, compliance failures.

DAM Features That Keep You On-Brand

An effective DAM software makes sure that your digital assets are easy to maintain, easy to manage, and easy to access Here’s what to look for in the features:

- Shared Libraries – Shared libraries act as a single source of truth for slides, charts, bios, and other digital assets. Analysts can pull pre-approved content instantly, without second-guessing

- Tombstones – A centralized, presentation-ready library of deal credentials. Tombstones let you filter by industry, region, or date to showcase your track record accurately and quickly

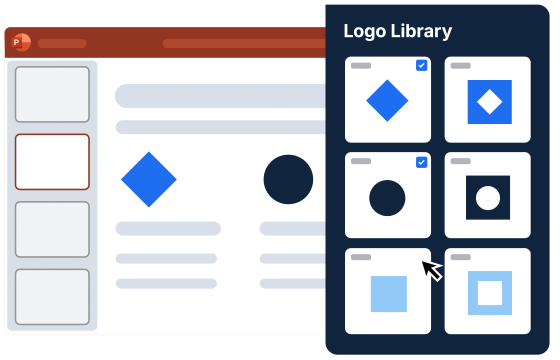

- Logo Library – Direct integration with a database of global brands makes sure you’re always using the most current, correct logo, which means no more last-minute searches or formatting errors

- Presentation Templates – Dynamic templates that auto-sync agendas, pre-populate disclaimers, and apply standard layouts and formatting mean brand compliance is front and center

Together, these digital asset management tools take the friction out of creating client-ready materials, so you can focus on the analysis and strategy that win deals.

Scale without Losing Control with Enterprise-Grade Functionality

A boutique team might manage with ad-hoc folders. But for large finance and banking firms, scalability is everything. You need a DAM platform that grows with your business, without sacrificing control or security.

Here’s what that should look like:

- Granular permissions – Control who can view, edit, or publish assets at the individual or team level

- Scalability – The ability to support hundreds or thousands of users across multiple regions

- System integration – Direct connections with the tools your bankers already use (PowerPoint, Excel, Word), so adoption is seamless

- Firm-wide consistency – Whether a pitchbook is built in London or Hong Kong, the branding, logos, and disclaimers match your firm’s standards

This is where a true enterprise digital asset management solution separates itself from lightweight tools that can’t keep up with the demands of banking and finance.

Common Pitfalls to Avoid

Even the best DAM solution can be problematic if you don’t implement it correctly. Here are the mistakes financial institutions often make:

- Choosing a generic DAM – Platforms built for marketing teams won’t have the compliance, tombstone, or PowerPoint integrations you need

- Ignoring permissions – Without the right access controls, you risk both exposure and inconsistent branding

- Underestimating adoption – If the platform isn’t embedded where your team works (PowerPoint, Excel), they’ll default back to old habits

- Treating brand compliance as optional – Every small inconsistency sends a message. A deck with inconsistencies reflects poorly on your firm

Avoid these traps, and you’ll get the full value out of your investment.

Building the Business Case

Implementing an enterprise DAM for finance and banking is every bit as important for your reputation as it is for speed and efficiency. Every client presentation affects your firm’s credibility. With secure, compliant, and consistently on-brand materials, you’re sending the right signal.

At the same time, you’re saving hours of wasted effort each week. Analysts aren’t spending time hunting for logos or tombstones. Associates aren’t reformatting disclaimers. Managing directors aren’t worrying about whether a client’s deck matches firm standards. The system handles it, so your team can focus on higher-value work.

Choosing the Right Partner

Not all digital asset management companies understand the unique needs of finance and banking. Look for a vendor with deep experience in your workflows, who understands the regulatory landscape, offers enterprise-grade functionality out of the box.

A platform purpose-built for institutions like yours will deliver the security, compliance, and usability you need without forcing your teams to reinvent the way they work.