Investment Bankers

Investment bankers heavily rely on Excel for analyzing companies, constructing intricate financial models, and consolidating data into impactful presentations. The pressure to deliver flawlessly precise work within tight deadlines amplifies the significance of their tasks.

Unstructured spreadsheets, filled with scattered inputs from various bankers, have a detrimental impact on the efficiency of the process. However, there is a solution to this problem—the Super Find tool. It effectively identifies inconsistencies and accelerates audits.

Find Differing Assumptions Across Models

Bankers often gather data from various analysts’ models to create a comprehensive analysis for their clients. It is vital to identify any inconsistent assumptions.

Super Find makes it easy to identify mismatches across models by searching for:

- Revenue growth rates that differ between business units

- Variable costs not equal between operating models

- Duplicate companies in comp analyses from various sources

Find Formula Errors Before Client Delivery

Verifying the integrity and consistency of the model holds utmost importance prior to delivering it to clients. However, manually auditing enormous models comprising thousands of cells can be an incredibly tedious task.

Super Find allows rapidly honing in on key items like:

- Formula errors causing #REF! or #DIV/0!

- Cells still referencing deleted worksheets

- Unprotected cells containing hard-coded assumptions

- Formulas pointing to blank inputs

This approach to surgical auditing saves valuable time by automating verification processes, instilling confidence in the delivery of error-free models.

Searching for a Manager’s Comments in an Excel Model

Bankers often include comments in models to explain assumptions or draw attention to concerns for reviewers. However, going through these details in lengthy and intricate models can be quite challenging.

Super Find instantly compiles all reviewer remarks across multiple versions so nothing gets overlooked:

- Find all comments from the MD before sending analysis to clients

- Locate notes on erroneous assumptions flagged in previous builds

- Check areas where VP provided guidance to explain approach

To search for comments in Super Find

- Open latest model version along with prior versions

- In Super Find, search “Comment Contains”

- Enter MD’s or VP’s name to view their remarks

- Scan results to ensure critical comments were addressed

Private Equity

Private equity firms rely heavily on complex Excel models that are interconnected. These models are used to assess company valuations, simulate leveraged buyout (LBO) scenarios, and evaluate the performance of investment funds.

To avoid losing sight of vital data points within the extensive financial models that encompass hundreds of tabs and connect to various source data, Super Find offers a convenient way to highlight any necessary information.

Filter Data Dumps for Further Analysis

Private equity firms compile extensive data rooms filled with thousands of rows of operational and financial information organized in Excel. The task of sifting through this overwhelming amount of data can be quite intimidating.

Find relevant nuggets like:

- Key financial metrics above or below a threshold

- Revenue by product matching a growth pattern

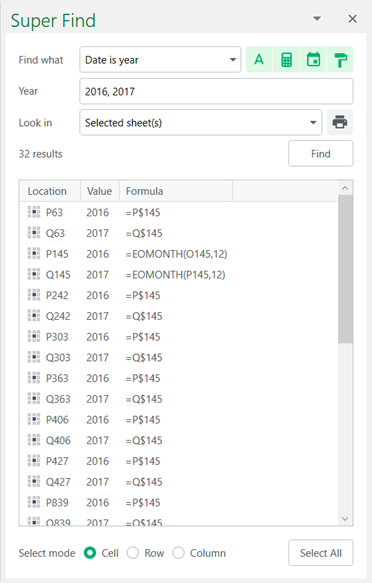

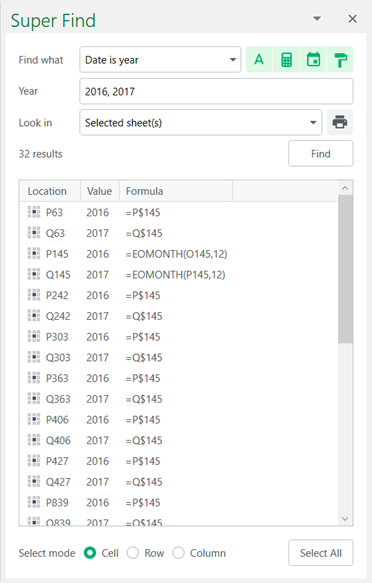

- Dates falling in the same period as strategic events

How to isolate relevant data from overwhelming data using Super Find:

- Import data dump into Excel

- Use Super Find to search “Value Greater Than”

- Enter revenue threshold to filter for high-value products

- Select results and copy to new sheet for analysis

- Repeat using different criteria like dates or keywords

Analysts attain a broader understanding by focusing on key areas of importance, rather than overwhelming themselves with an excessive amount of data.

FP&A

FP&A teams rely on Excel to consolidate financial data from across the organization. They use it to create budgets, forecasts, and variance analyses.

FP&A analysts face a challenging situation when they have to navigate through disconnected spreadsheets dispersed across different departments. This scattered data makes it difficult for them to discern meaningful insights from the overwhelming amount of information.

Find Discrepancies Across Data Sets

Identifying inconsistencies in consolidated reports can be a major headache for FP&A teams as data compiles from various sources.

Super Find provides quick assurance by detecting mismatches like:

- Sales figures that differ across business unit models

- Headcount numbers not equal between departments

- Expense assumptions not matching plan vs. forecast

Speed up Variance Analysis

Analyzing discrepancies between forecast and actuals involves laborious manual comparisons across extensive datasets.

Super Find simplifies variance analysis by quickly finding:

- Actuals different from projected amounts

- Current year balances matching prior year

- Changes in variance drivers between periods

Compare actuals vs. forecast more efficiently using Super Find:

- Open Excel files with actuals and forecasts

- Search for “Value Not Equal To”

- Enter projected Q1 revenue amount

- See where actuals differ and assess drivers

- Repeat search for other top-line variance factors

FP&A teams are able to provide insightful explanations rather than basic reporting, enabling a deeper level of understanding.

Accounting

Accountants heavily rely on Microsoft Excel as their go-to tool for collecting and organizing data from various systems. This enables them to efficiently generate financial statements, maintain general ledgers, and produce other essential outputs.

When it comes to ensuring accuracy and consistency across these critical spreadsheets, having a comprehensive overview becomes crucial but challenging.

Simplify Spreadsheet Audits

Super Find reduces audit stress by quickly confirming:

- All statements use matching formatting

- Formulas comply with accounting standards

- No erroneous prior year data lingers

- Changes tied to notes explaining adjustments

Using Super Find:

- Open financial statements in Excel

- Use Super Find “Format Equal To”

- Enter number format used in Statements

- Review any inconsistencies

- Search “Formula Contains” for standards

Accelerate Period-end Closing

Closing the books involves the process of reconciling accounting periods and comparing changes to previous years. This task becomes laborious when dealing with intricate spreadsheets that are prone to errors.

Super Find makes period-end closing easier by instantly finding:

- Dates falling in the period being closed

- Balances matching last year’s amounts

- Formulas linking to prior year worksheets

- Changes tied to adjusting journal entries

Using Super Find, isolate data from closed period:

- Open GL and financial statements

- In Super Find, search “Date Equal To”

- Enter last date of closing period

- Copy results to analyze period activity

- Search differences vs. last year

How Super Find Works

Now that the ways Super Find tackles real-world challenges for finance teams have been presented, let’s delve into its inner workings.

- Comprehensive search criteria: The search criteria provided offer a comprehensive approach to finding various elements such as values, formulas, formats, dates, errors, and more.

- Isolates matching results: The task pane allows for efficient management and analysis by isolating matching results and providing a clear view of these results.

- Focus your search area: You can search within selections or sheets.

- Works across multiple spreadsheets: Perform searches across multiple workbooks.

Finance professionals can now benefit from enhanced capabilities that enable them to efficiently navigate through complex spreadsheets, leading to quicker access to the information they require. By utilizing customized searches, these individuals can uncover concealed insights while effectively disregarding irrelevant data noise.

Examples of Super Find’s Powerful Search Operators

- Value Greater Than, Less Than, Equal To

- Date Next Month, This Quarter, Previous Year

- Formula Contains VLOOKUP, References Other Sheet

- Format Has Borders, Text Bold, Number Currency Style

The findings can be easily managed by selecting any or all matching results at once. Additionally, you have the flexibility to format them, create charts for visual analysis, feed them into a pivot table, or export them for further analysis.

Try Super Find for Free

By combining advanced search parameters with efficient analysis features, Super Find simplifies the manual investigation of massive and complex spreadsheets. The flexibility offered eliminates the tediousness associated with data exploration.