So, if you’ve ever been baffled by this niche valuation method, you’re in the right place. Let’s get started unraveling the ins and outs of the dividend discount model.

How the Dividend Discount Model Works

The core premise is that today’s stock price represents the discounted value of all expected future dividend payments.

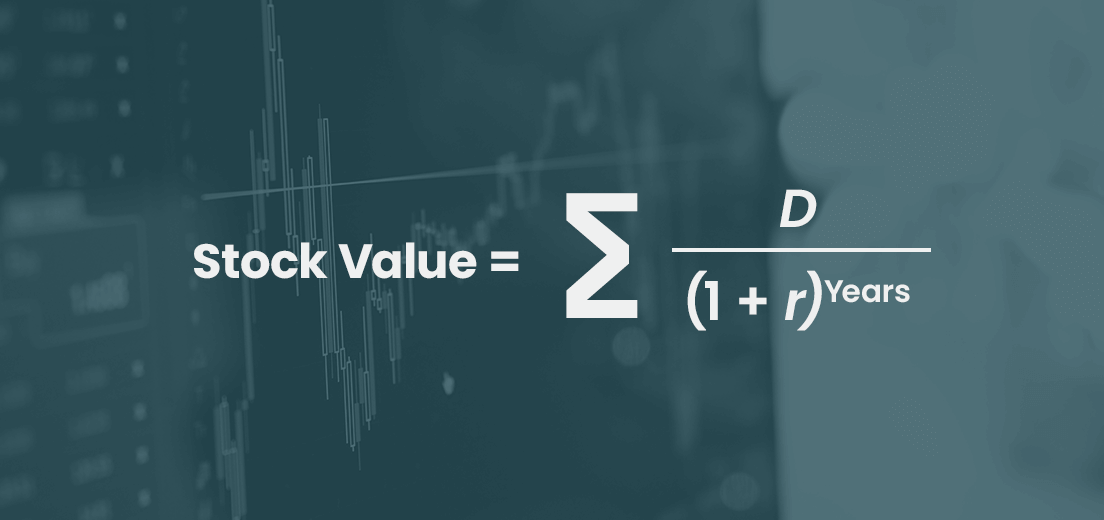

Mathematically, the dividend discount model formula is:

Where:

- Stock value is the estimated intrinsic value

- Dividends are the estimated future dividends

- Cost of equity is the required annual return

- Years represents the time period for each dividend

This mirrors the discounted cash flow model applied to dividends rather than free cash flow.

The equation may look intense at first glance. But breaking it down step-by-step removes the complexity.

Setting Realistic Assumptions

When constructing a dividend discount model, the quality of your inputs determines the usefulness of the output. Be deliberate when making assumptions.

Let’s explore the crucial factors to weigh when estimating the two most pivotal DDM assumptions – dividend growth rate and cost of equity.

Dividend Growth Rate

Anchoring growth assumptions requires digging into historical trends and future contexts:

- Study at least 5-10 years of historical dividend growth rates. Identify the average and range. Beware of outliers.

- Factor in earnings growth estimates. Dividend increases tied to earnings provide confidence.

- Gauge where the payout ratio stands relative to history. High payouts limit future growth.

- Incorporate inflation expectations. Rising prices may spur faster dividend hikes.

- Compare to industry norms. Aligning with peer averages improves credibility.

- Contrast with GDP growth forecasts. Expansion may suggest faster hikes, while recession flags caution.

- Weigh macro factors like interest rates that may sway investor expectations.

The goal is defensible growth assumptions grounded in historical context and reasoned future analysis.

Cost of Equity

The cost of equity represents your required return, given the riskiness of the business. It serves as the discount rate applied to future dividends.

For public companies, leveraging the capital asset pricing model (CAPM) based on the beta provides a reasonable estimate.

Cost of Equity = Risk-Free Rate + Beta x Market Risk Premium

Private companies require more judgment on an appropriate cost of equity. Consider comparable public companies and growth expectations.

- Leverage the CAPM model incorporating company beta to benchmark against peers.

- Evaluate how volatility and risk premiums may be evolving for the industry.

- Consider current and expected interest rate environments. Rising rates lift return expectations.

- Assess changes in company leverage. Higher debt drives up cost of equity.

- Survey investment managers on expected return targets given perceptions of risk.

- Study historical market returns across bull and bear cycles to set realistic goals.

- Factor in growth outlooks. Higher projected expansion supports higher cost of equity.

Aim for cost of equity assumptions consistent with peer benchmarks and investor return expectations given risk.

The bottom line is crafting realistic assumptions requires rigorous research into company history, peer benchmarks, market conditions, and growth prospects.

Cost of Equity

Dividend Growth Rate

The dividend growth rate drives projected dividends and terminal value. Base this on historical growth rates and estimated earnings growth.

Be conservative in your assumptions unless the company has strong indicators of high growth ahead.

Payout Ratio

The portion of earnings paid out as dividends rather than retained affects growth assumptions. Track the historical payout ratio trends.

High-growth firms tend to retain more earnings, suggesting lower payout ratios and dividend growth.

Terminal Value

Terminal value often makes up a substantial portion of total value. Use sensitivity analysis to stress test your terminal value assumptions.

Common techniques include the stable growth Gordon Growth Model or exit multiples like EV/EBITDA.

Applications: When the Dividend Discount Model Shines

Now that we’ve broken down the inner workings, where does the DDM actually add value? Here are a few of its sweet spots:

Value Investing

Savvy investors can use a DDM to sniff out potentially undervalued dividend stocks. For example, they may build a model for Coca-Cola (KO) using conservative inputs like a 3% dividend growth assumption and 7% cost of equity based on comparable firms.

If the model spits out an intrinsic value of $60 versus the current trading price of $55, it could signal an overlooked opportunity. The DDM reveals Coke may be trading at a 10% discount to fair value. Comparing model price to market price identifies discrepancies.

Forecasting Scenarios

Strategic leaders can test how potential dividend policy moves could play out by modeling various scenarios. Imagine a management team is weighing lowering the dividend payout ratio to free up capital for expansion.

They could flex that assumption in the DDM to see how a reduction to 20% may impact share price under different growth scenarios. This provides valuable forecasts of potential outcomes if they reduced dividends to plow funds into high-return projects.

Comparing Companies

Investment analysts often evaluate peers using discounted dividend analysis. For example, an analyst could crunch the numbers on Coca-Cola (KO) and Pepsi (PEP) using identical conservative assumptions.

Comparing the intrinsic values sheds light on which stock appears relatively underpriced if a meaningful valuation gap emerges. This method enables apples-to-apples comparisons even for very different companies, given equal inputs.

M&A/LBO Models

During mergers or acquisitions, the acquiring company can factor in a DDM to evaluate deal impacts on shareholder value.

For instance, in a takeover scenario, a buyer could model cutting the target company’s dividend in half post-close to redirect cash towards paying down acquisition debt. This reveals the valuation hit from reduced dividends if they pursue that route, helping inform bid pricing.

See how this could work in an LBO model.

Stock Screening

Investors can systematically screen for attractively valued dividend payers using a standardized DDM. For example, scanning for stocks with at least a 15% margin of safety between the DDM fair value and market price, using consistent conservative assumptions, would identity promising candidates trading below intrinsic worth. The DDM allows screening for undervalued dividend stocks in scale.

Example: How Does the DDM Work in Practice?

To see the nuts and bolts of the DDM formula in action, let’s walk through a straightforward hypothetical case to see the basic DDM in action.

Imagine we have a stable fictional company called Lakeview Inc that just paid shareholders an annual dividend of $1 per share.

Through analyzing comparable firms, we estimate Lakeview’s cost of equity is approximately 12% based on its risk profile.

Given Lakeview’s consistent payout history, solid market position, and 5% annual earnings growth rate, we assume the dividend can reasonably grow at 5% per year going forward.

With these basic inputs, we can now project the future annual dividends. Applying the 5% growth rate, next year’s dividend would be $1 * 1.05 = $1.05.

In the final step, we discount those future dividends back to today at our 12% cost of equity to derive an intrinsic value.

Plugging the numbers into a simple model, we get an estimated fair value of $18 per share for Lakeview.

Comparing this to the current trading price of $15 suggests potential undervaluation. The DDM signals 20% upside.

Limitations and Downsides of the Dividend Discount Model

While useful in certain applications, the DDM has some drawbacks to acknowledge:

- Sensitive to assumptions – Small changes in cost of equity or growth estimates swing value dramatically.

- Forecasting error – Making accurate long-term dividend projections is virtually impossible.

- Static view – Fails to account for future strategy shifts, economic changes, or new risks.

- No reinvestment – Ignores value generated from reinvesting earnings at high-growth firms.

- Hard valuing non-dividend payers – Companies with low or no dividends are difficult to value.

- Favors dividends – Rewards dividend payers over companies that responsibly retain and invest earnings.

For these reasons, the DDM works best when combined with other valuation approaches like DCF, multiples, or precedent transactions.

Dividend Discount vs. Dividend Growth Model

Newcomers to dividend modeling often confuse the dividend discount model and dividend growth model.

While similar on the surface, there are some key differences:

- Dividend Discount Model – Values based on estimated future dividends discounted to the present.

- Dividend Growth Model – Calculates a fair value based on multiplying the next year’s dividends by a valuation ratio of (Cost of Equity – Growth Rate) / Cost of Equity.

- Time Horizon – DDM uses multiple periods with a terminal value. Gordon Growth is based solely on next year’s dividend.

- Outputs – The dividend discount model provides a full valuation. Gordon Growth offers a fair multiple.

In essence, Gordon Growth is a simplified one-year case of the multi-period DDM. Both offer useful perspectives.

The dividend discount model provides a window into the value of future dividends, given reasonable growth assumptions.

While the methodology is sound, thoughtfully scrutinizing the inputs and weighing against various scenarios is key. Garbage in, garbage out applies heavily.